Every year a business or individual is required to file for an income tax return which has been made easy by using the online CRA (Canada Revenue Agency) service where you need to create a CRA account.

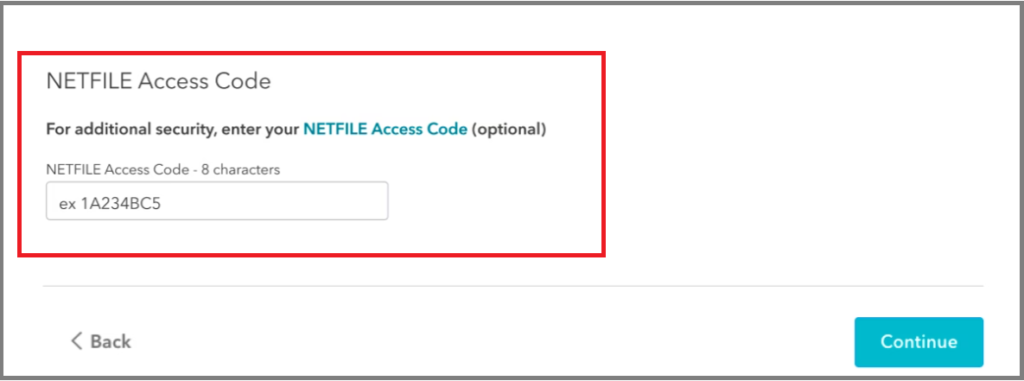

You can also use NETFILE which is an electronic tax filing service to do taxes online and send them to CRA. To authenticate the service you will receive a unique access code.

If you are wondering about the CRA access code then read this article to know where is NETFILE access code and how to locate it.

What Is A CRA NETFILE Access Code?

NETFILE access code is a unique 8-digit code that is a mix of numbers and alphabets which is available on the Notice of Assessment or your CRA MyAccount.

After the 2020 tax year, every individual is required to enter NETFILE Access Code to use the information of tax return information from the year 2022. The access code is required to confirm your identity.

If you are filing taxes for the first time then it will not apply to you.

Where Is The NETFILE Access Code On Notice Of Assessment?

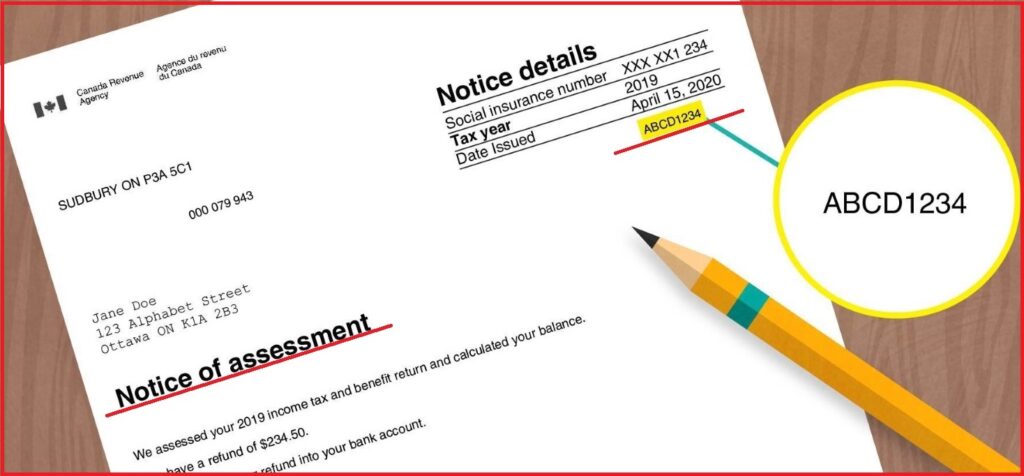

You can get your NETFILE access code on your Notice of Assessment from previous years’ tax returns.

To get your NETFILE access code check the Notice of Assessment either from CRA MyAccount or if you receive it in paper format through mail then you can see the access code on the right side below the date.

The access code will be a unique mix of numbers and alphabets that you can find always on the right of your notice of assessment.

The location and writing may differ depending on the format of the notice of assessment.

If you check the paper version of the notice of assessment or the PDF version in MyAccount, the code is not labelled or marked but is always placed below the issued date on the top right side.

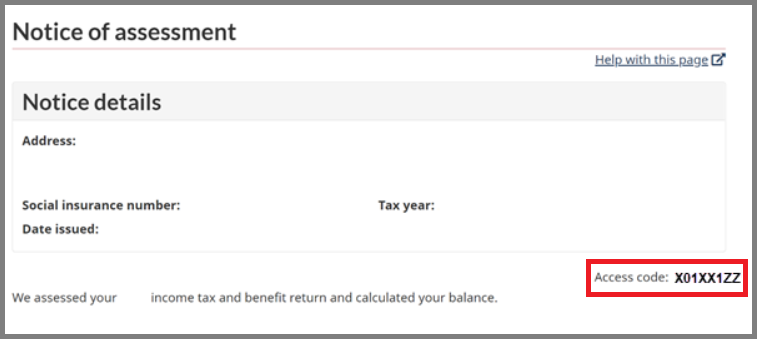

But when you check your notice of assessment in the MyAccount or Express notice of assessment in certified tax software the access code is labelled and is placed on the right side just below the notice details box.

This is an optional authentication process to confirm your identity.

If you don’t have a NETFILE access code then you can enter your other tax return information to confirm the identity verification when you are in contact with the CRA.

Advantages Of Using NETFILE For Tax Return

NETFILE makes tax filing easy and has the following benefits:

- You can file your taxes with NETFILE-certified tax software which reduces your chance of error.

- You get immediate confirmation about receiving your tax return.

- You don’t have to send in receipts and can be sent at a later date when asked for them.

- Your refund gets processed faster through direct deposits and you may get it in two weeks.

The NETFILE hours of service are available for 21 hours a day but remain closed for three hours daily from 3 am to 6 am due to maintenance activities.