When you pay for your phone service with Xfinity Mobile, you might notice some extra charges on your bill. These are taxes and fees that the government or phone company adds.

The amount you pay can change depending on where you live and how much you use your phone.

This article will talk about these extra costs from Xfinity Mobile so you know what to expect on your bill.

What are Xfinity Mobile Taxes and Fees?

When reviewing your Xfinity Mobile bill, you’ll notice various taxes and fees that are added to the cost of your service plan.

These charges are generally mandated by governmental entities and can vary by location and usage.

1. Basics of Mobile Taxes and Fees

Xfinity Mobile operates as a postpaid service, meaning charges are incurred after service use. Your bill reflects the cost of the plan plus additional taxes and fees.

These charges can include state and local sales taxes, regulatory recovery fees, which are not government-mandated but are allowed by law, and other costs associated with your service.

A typical Xfinity Mobile bill may have a line item labelled as “Taxes, fees and other charges” which could add an amount such as $12.38 more to your advertised plan price depending on your location and the services that are chosen.

2. Federal, State, and Local Taxes

Your Xfinity Mobile bill includes federal, state, and local taxes which can significantly affect the total amount due. These taxes are levied based on the service address on record and can include:

- State and Local Sales Tax: Calculated as a percentage of your service fee.

- Utility Taxes: Specific to local jurisdictions, may apply to wireless services.

The specific amounts and types of state and local taxes can be found on detailed sections within your billing statement.

3. Mandatory Government Charges

Among the taxes and fees on your Xfinity Mobile bill, you’ll find mandatory government charges. These fees are non-negotiable and are mandated for all telecom providers:

- 911 Fees: Supported by a $1.64 charge to fund emergency services.

- Federal Universal Service Charge: A fee that supports telecommunications services in underserved areas.

What is Xfinity Mobile Fee Structure?

When you sign up for Xfinity Mobile’s services, be prepared to see a variety of fees on your monthly bill. These are categorized as administrative, regulatory recovery, and usage-based fees.

1. Administrative Fees

Xfinity Mobile charges an administrative fee that encompasses costs associated with maintaining your wireless account and services.

This fee can fluctuate and is not directly related to the regulatory charges imposed by the government.

The specifics, including the exact fee amount, may vary and are subject to change.

2. Regulatory Recovery Fees

Your bill will also include regulatory recovery fees. These are not government-mandated taxes but are intended to help Xfinity Mobile recover the costs of federal, state, and local regulatory programs.

For example, one of the items included in this fee is the Universal Connectivity Charge, which is detailed by a real user’s bill experience.

3. Usage-Based Fees

Finally, there are usage-based fees that appear on your bill, which vary depending on your consumption of services outside your plan’s stipulations.

Examples include international calling, data overages if you surpass your plan limit, or roaming charges when travelling.

For a more comprehensive overview of possible charges on your statement, you might want to check the information on charges on your Xfinity Mobile account statement.

Details on Xfinity Billing and Payment

Understanding your Xfinity Mobile billing and payment procedures is crucial to manage your account effectively.

You will find straightforward details about your billing cycle, accepted payment methods, and what happens if a payment is late.

1. Billing Cycle and Statements

Your billing cycle for Xfinity Mobile operates every month, with statements that provide a summary of the previous cycle’s usage, charges, and payment status.

Detailed on your statement are items such as data charges, taxes, fees, and other charges. You’ll typically receive your bill at the same time each month, so it’s important to note this date to avoid any surprises.

Your Xfinity Mobile billing cycle runs every month. You will receive your bill around the same date each month. It’s important to note this date to avoid late fees.

Your monthly statement provides a summary of charges from the previous billing cycle. This includes data usage, taxes, fees, minutes/messages used, device charges, payments, and account credits.

You can view line details, call/text histories, data usage, charges, credits, and taxes/fees like the 911 fee or Universal Connectivity Charge. Sales tax and government fees may also appear.

Steps to view your Xfinity Mobile billing statement:

- Log in to your Xfinity Mobile account online or open the Xfinity Mobile app.

- To view your current billing cycle:

- Select “Billing”

- Select “View Current Cycle”

- View your current balance, charges, credits, and data/minute usage

- To view a past billing statement:

- Select “Billing” then “Payments”

- Click on the payment amount for the statement date you want to view

- Click “Details”

- Select the line to view call/text history

Or:

- In the app, select “Statement History”

- Choose the statement date

- Select the line to view usage details

- Billing statement details include:

- Data charges

- Taxes and fees like 911 fee or USF charges

- Device costs

- International charges

- Account credits

- Call and text usage by line

- Check for recurring charges like tablet/watch fees

- Sales tax is based on the line value, not usage

- Fees are subject to change, check for notice of adjustments

- Contact Xfinity support if you have any billing questions

Regularly reviewing your statements will help you track usage and costs to avoid late fees.

2. Methods of Payment

Xfinity Mobile offers several methods of payment to ensure convenience for your lifestyle. You can choose to set up Auto Pay, which automatically deducts your monthly bill from a designated bank account or credit card.

Alternatively, you may make payments manually online through Quick Pay, over the phone, or at an Xfinity store.

Using a credit card with cell phone protection can offer additional perks when paying your bill.

3. Late Payment Policies

Should you miss your payment due date, Xfinity Mobile’s late payment policies come into effect.

A late fee may be added to your bill for the following month. To prevent this, it is advisable to keep your account on Auto Pay.

If circumstances may delay your payment, contacting Xfinity Mobile promptly can help manage the situation and potentially avoid late fees.

What are the Steps to calculate Xfinity Mobile Taxes and Fees?

Below are the steps that you can use to calculate Xfinity Mobile taxes and fees.

1. Review Your Xfinity Mobile Plan Details

Start by understanding the specifics of your mobile plan, including the base cost of the plan, the number of lines, and any additional services or features you have subscribed to.

2. Identify Fixed Fees

Look for any fixed fees that Xfinity Mobile charges. This could include costs like the 911 service fee, which, according to an Xfinity Community Forum post, seems to be $1.50 per line.

3. Determine Variable Taxes and Fees

Variable taxes and fees are calculated as a percentage of your bill and can include state and local taxes, as well as federal taxes. These are not flat rates and will depend on your location.

4. Check for Recent Changes or Increases

Keep an eye on any recent changes to taxes and fees, as they can fluctuate. For example, there might be discussions on forums like the Xfinity Community Forum that indicate recent increases or changes in fee structures.

5. Calculate the Taxes and Fees

Once you have all the necessary information, add the fixed fees to the base cost of your plan. Then, calculate the variable taxes and fees based on the percentages that apply to your location and add them to your total.

6. Review Your Billing Statement

Xfinity Mobile’s billing statement should itemize the taxes and fees. You can use this to cross-reference your calculations and ensure accuracy.

7. Contact Xfinity Mobile for Assistance

If you are unsure about any charges or need help with the calculation, you can contact Xfinity Mobile customer service for clarification.

Cost Comparison of Xfinity Mobile with Others

When choosing your mobile plan, it’s important to consider how Xfinity Mobile’s pricing stacks up against its competitors and to understand the various taxes and fees that will appear on your bill.

1. Comparing Xfinity Mobile with Competitors

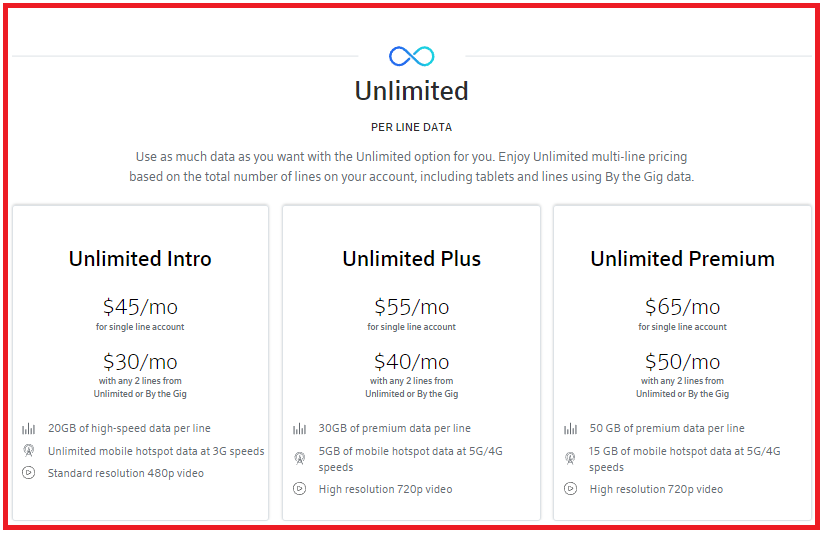

Xfinity Mobile offers competitive rates, especially if you’re already a customer of their internet services.

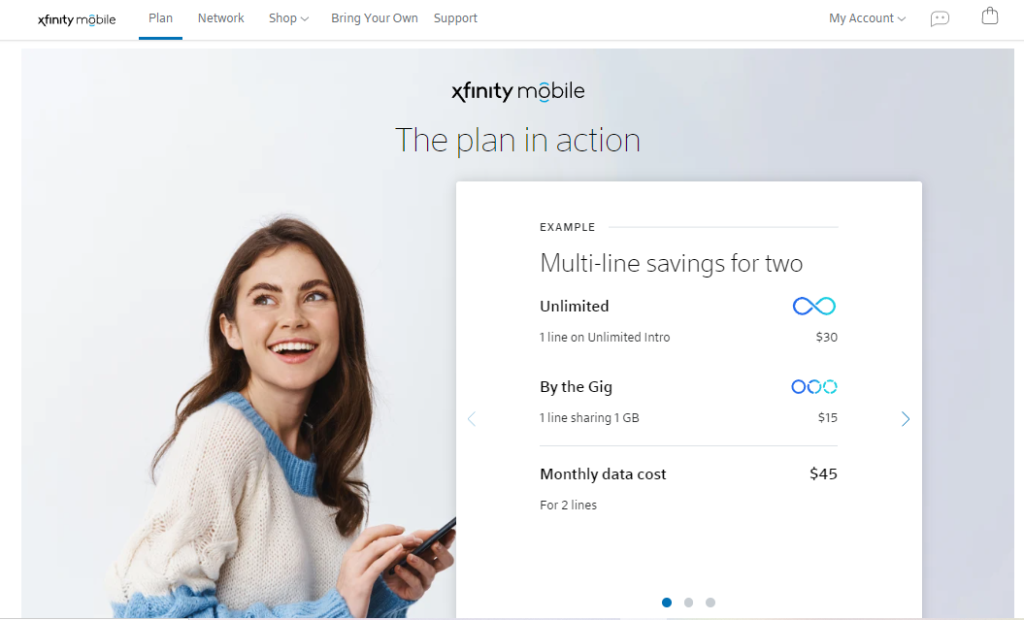

For instance, you could opt for a single line at $45 per month, inclusive of unlimited data. In comparison to major carriers, this can be a more affordable option, particularly when adding multiple lines, where you can get a discounted rate of $30 per line.

Competitor Pricing Comparison:

- Verizon: Depending on the plan, prices range higher but may include additional perks.

- AT&T: Similar pricing structures, but potential savings for larger family plans.

- T-Mobile: Offers competitive unlimited plans that may be cost-effective for heavy data users.

It’s essential to examine specific promotions, as deals like getting a Samsung Galaxy S23 might shift the cost-benefit analysis in favor of one carrier over another.

2. Analyzing Your Mobile Bill

Your Xfinity Mobile bill will include several taxes and fees on top of the base price of the plan.

A new Xfinity Mobile user recently pointed out additional fees amounted to $12.38 extra, including 911 fees and other communications taxes. Here’s a quick breakdown of potential additional costs you might see:

- 911 Fees: A mandated surcharge for emergency services.

- Communications Sales Tax: Varies by state and local jurisdiction.

- Federal Universal Service Charge: A fee designed to keep service rates affordable for all.