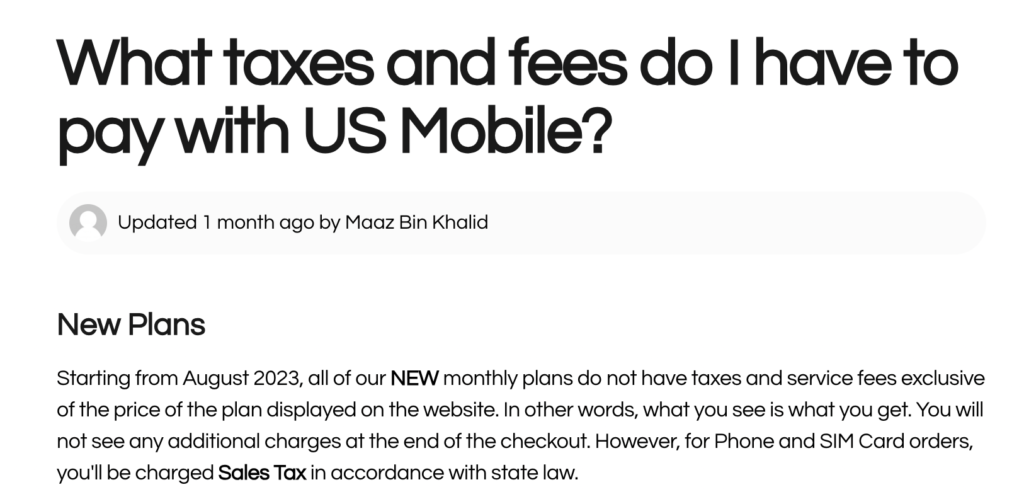

When you pay for your phone service with US Mobile, you might notice some extra charges on your bill. These are taxes and fees that the government or phone company adds.

The amount you pay can change depending on where you live and how much you use your phone.

This article will talk about these extra costs from US Mobile so you know what to expect on your bill.

What are US Mobile Taxes and Fees?

When examining your US Mobile phone bill, you will encounter various taxes and fees that can significantly affect the total amount you pay each month.

1. Types of Mobile Taxes

US Mobile includes certain taxes that are standard across the industry. This typically involves sales tax, which is contingent on your state’s legislation, and a recovery fee that groups multiple taxes together.

2. Federal Universal Service Fund

Your bill also contributes to the Federal Universal Service Fund (FUSF), which aims to ensure that telecommunications services are available to all consumers across the United States.

A nominal fee is included in your monthly charges for this federal program.

3. State-Level Taxes and Fees

Beyond the federal level, your bill will reflect state-imposed taxes and regulatory fees.

Each state mandates its own set of taxes, which US Mobile is required to collect on behalf of various government entities.

4. Local and Municipal Charges

Lastly, you may see local and municipal charges on your bill. These are additional fees imposed by local governments, which will vary based on your geographical location and the specific ordinances in place within your municipality.

Breakdown For The Taxes and Fees in US Mobile

When you sign up for a plan with US Mobile, your bills will include certain taxes and fees. Here’s a breakdown of what you might expect on your monthly bills:

Sales Tax: This is dependent on state law and applies to both phone and SIM card orders.

Monthly Service Fee: A consistent charge that you will see in relation to your cell phone plan.

- GSM LTE Plans: $2

- Super LTE Plans: $2

Regulatory Cost Recovery Fee: It helps cover costs imposed by the government on US Mobile, and it may vary based on the services you are using.

Recovery Fee: This is a grouped charge on your monthly plan that includes various taxes.

Examples of Other Possible Regulatory Fees:

- Federal Universal Service Fund

- Telecommunications Relay Services

- State Telecommunications Excise Tax

- Local Sales and Use Tax

These fees contribute to the maintenance and operation of telecommunications services nationwide.

To see a complete breakdown of the charges, you can review your bill’s details through your account portal before final payment.

This transparency ensures that you’re informed about every charge being applied to your monthly service with US Mobile.

What are the Steps for Calculating US Mobile Taxes And Fees?

You can estimate the taxes and fees for a US Mobile plan by considering the information that is available:

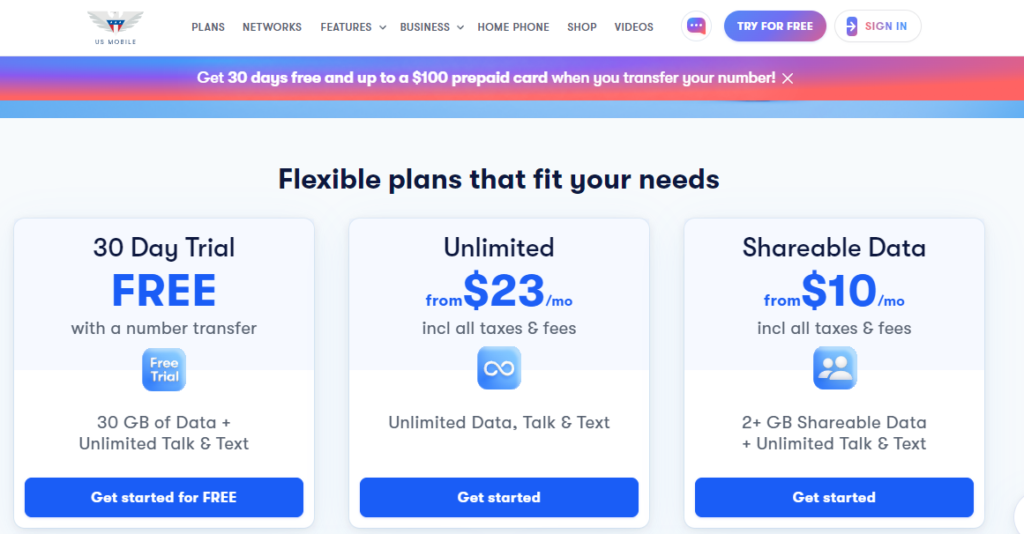

- Select Your Plan: Start by choosing a plan on the US Mobile website. They offer custom and unlimited plans, and you can choose from various options for talk, text, and data.

- Review the Base Cost: Note the base cost of your plan. This is the advertised price before taxes and fees.

- Consider the Service Fee: US Mobile charges a monthly service fee. This fee can be $2 for both GSM 5G and Warp 5G plans.

- Estimate Taxes and Regulatory Fees: Taxes and regulatory fees can vary depending on your location. While there isn’t a specific calculator provided, US Mobile mentions that taxes on their plans start from $0.10 and almost never get over $0.50 for 30 days.

- Calculate the Total: Add the base cost of your plan, the service fee, and the estimated taxes to calculate the total amount you can expect to pay monthly.

How to Minimize US Mobile Taxes and Fees?

When you’re looking to reduce the taxes and fees on your US Mobile bill, consider the following steps:

1. Choose the Right Plan

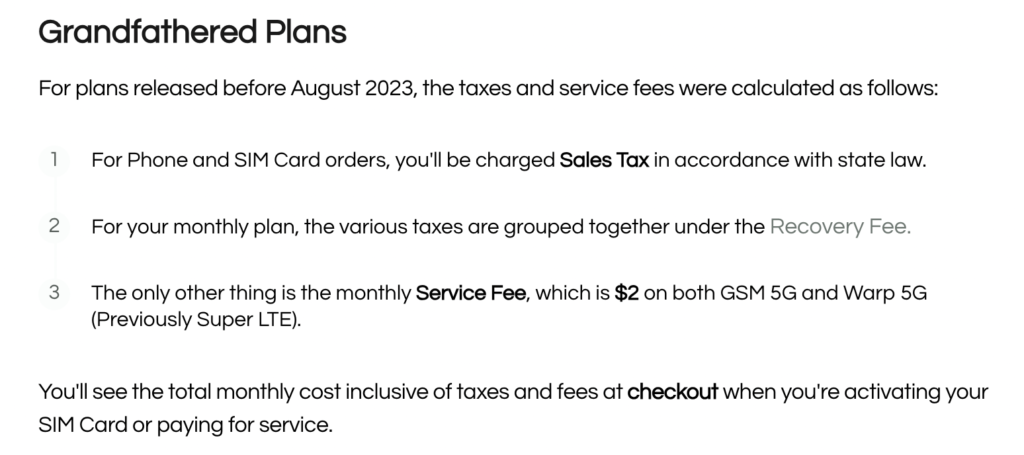

Select a monthly plan that fits your usage patterns. New monthly plans introduced by US Mobile starting from August 2023 are structured to be more transparent, with taxes and service fees included in the price you see on their website.

2. Monitor Your Usage

Keep an eye on your data, texts, and call usage. Avoid overage fees by staying within your plan’s limits or using Wi-Fi when possible.

3. Understand Your Bill

Check your bill for a breakdown of fees. Regulatory cost recovery fees can be a part of your bill, as seen in discussions from US Mobile’s community.

4. Prepaid Plans

Consider using a prepaid plan where taxes and fees can be more predictable and are usually included in the advertised price.

5. Ask for Discounts

Check if you’re eligible for any discounts through your employer, college, or membership in organizations that may offer a reduced rate on mobile services.

6. Pay Online

Avoid paper billing fees by opting for electronic statements and payments. Use auto-pay to ensure you never miss a payment and prevent late fees.