When you pay for your phone service with Red Pocket, you might notice some extra charges on your bill. These are taxes and fees that the government or phone company adds.

The amount you pay can change depending on where you live and how much you use your phone.

This article will talk about these extra costs from Red Pocket so you know what to expect on your bill.

What are Red Pocket Taxes and Fees?

When you choose a Red Pocket mobile plan, you’ll encounter various taxes and fees that can add to your monthly bill.

It’s essential to understand that these additional charges may vary depending on your location and the specific plan you select.

1. Federal Charges

- Federal Universal Service Fund (FUSF): This fee goes towards providing affordable telecommunications services across the country. An example could be a $0.28 charge on a $19.00 plan.

- Federal Telecommunications Relay Services Fund: This assists with the costs of relay services for individuals with hearing or speech disabilities. There are typically two types: Non-IPCTS and IPCTS, with minor fees attributed to each.

2. State and Local Taxes

- State Sales Tax: You’re charged according to your state’s sales tax rate.

- Prepaid Wireless 911 Surcharge: This is a fee mandated by many states to fund emergency services.

- State Universal Service Fund: Similar to the FUSF but at a state level, it ensures affordable telecommunications services within the state.

The exact figures for these taxes and fees will depend on your state laws and the cost of your plan.

Sample Breakdown for a $19.00 Plan:

| Fee Type | Possible Cost |

|---|---|

| Federal Universal Service Fund (FUSF) | $0.28 |

| State Sales Tax | $0.25 |

| Prepaid Wireless 911 Surcharge | $0.05 |

Understand the Taxes on Red Pocket Transactions

When you’re considering a mobile plan with Red Pocket or looking to make a payment through their site, it’s essential to be aware of the various taxes that may apply.

These could range from standard sales tax to specific telecommunications levies.

1. Sales Tax

Every purchase you make with Red Pocket, including service plans, may be subject to sales tax depending on the state you reside in.

For example, when purchasing via Red Pocket’s site, sales tax is calculated based on the billing address you provide.

2. Telecommunications Tax

Telecommunications Tax applies to any service related to electronic communications.

For Red Pocket users, this tax can appear on your bill alongside federal and state-level charges.

- Federal Universal Service Fund: This fee supports telecommunications services in rural and high-cost areas, income-eligible consumers, rural healthcare facilities, and schools and libraries. It’s a percentage of your interstate and international telecommunication charges.

- State Communication Sales Tax: Specific to your state, this tax supports state telecommunications services.

3. VAT and GST

If you’re purchasing Red Pocket services outside the United States, you might be subject to Value-Added Tax (VAT) or Goods and Services Tax (GST).

These are consumption taxes placed on a product whenever value is added at a stage of production and at the final sale.

4. E911 Fees

Most states in the U.S. collect an E911 fee on wireless phone bills to support emergency communication services.

This fee is set by the state, county, or city where you’re located and can vary widely.

- E911 State Fee: A fixed charge that contributes to the maintenance and improvement of your state’s emergency telecommunications infrastructure.

- E911 Local Fee: Similar to the state fee, but allocated for your local jurisdiction’s emergency response system.

What are the Fees Associated with Red Pocket Services?

Your experience with Red Pocket Mobile may include various fees beyond the advertised plan rates.

Understanding these charges ensures you stay informed about your total costs.

1. Activation Fees

When you sign up for a Red Pocket service, there is no activation fee. You can start using your service immediately after purchase without an additional charge for activation.

2. Recharge Fees

Red Pocket does not routinely charge a fee to recharge or top up your service.

Whether you renew your plan online or purchase additional credits, you should typically expect to pay only the stated cost of the service.

3. Service Convenience Fees

For certain payment methods, Red Pocket might include a convenience fee. These fees are often small and are associated with specific, less common forms of payment.

Always check the payment page for any potential service convenience charges when paying for your plan.

What are Government-Imposed Charges on Red Pocket?

When you pay for services with Red Pocket, the total amount includes several government-imposed charges.

These include federal, state, and local taxes and fees mandated by law.

1. Federal Universal Service Fund

The Federal Universal Service Fund (FUSF) fee is a charge set by the Federal Communications Commission (FCC) to ensure that all Americans have access to telecommunication services.

The rate is adjusted quarterly, and carriers like Red Pocket are required to collect and remit this fee from their customers.

2. State Telecommunications Excise Tax

In addition to federal fees, you’ll encounter state telecommunications excise taxes.

These are percentage-based charges applied to your Red Pocket service cost and vary by state. They’re used to fund state-wide communications services and infrastructure.

3. Local Utility User Taxes

Your Red Pocket bill may also include local utility user taxes. These are imposed by local governments and can vary greatly depending on your city or county. These taxes typically finance local utilities and related public services.

How to Calculate Red Pocket Taxes and Fees?

When planning to purchase a plan from Red Pocket, understanding the taxes and fees that apply can be essential for budgeting.

Your total cost will include the base price of the service plan plus applicable taxes and fees.

Step 1: Identify Your Plan’s Base Cost

Identify the base cost of your desired Red Pocket mobile plan. This is the advertised price before any additional charges.

Step 2: Add Federal Fees

Federal fees include the Federal Universal Service Fund and Federal Telecommunications Relay Services Fund. These are typically small percentages of your base cost.

Step 3: Calculate State Taxes

Your state may impose a sales tax on telecommunications services. Additionally, specific counties or cities may have their own taxes.

Step 4: Consider E911 and Local Surcharges

Some areas include an E911 fee to fund emergency services, as well as other local surcharges.

Step 5: Total Your Cost

Add all the identified federal, state, and local taxes and fees to your plan’s base cost to estimate your total charge.

Here’s a simplified breakdown:

- Base Cost: Price of your Red Pocket plan

- Federal Fees: Small percentages of federal funds

- State Taxes: Vary by location

- E911 and Local Surcharges: Additional fees that may apply

Remember, taxes and fees may vary based on your location, and Red Pocket’s online payment portal will provide the exact amounts during checkout.

Your final cost may be affected by changes in tax rates or the introduction of new regulatory fees.

What are the Impact of Taxes and Fees on Customer Billing?

When you subscribe to a mobile carrier like Red Pocket, understanding the additional costs on top of your monthly plan is important.

Taxes and fees can vary based on several factors such as your location and the specific plan you choose.

1. Location and State Taxes

Your state’s tax laws will dictate part of the charges. For example, a Reddit user from Indiana mentioned that they pay an additional $.35 tax per line for their service.

These taxes are mandatory and are collected by the carrier on behalf of the state.

2. Regulatory Fees

These are fees charged by the carrier to cover various regulatory requirements and costs.

For instance, the Regulatory Recovery Fee may apply if you purchase a plan directly from Red Pocket.

A Red Pocket forum discussion indicated a $12.00 charge, although this may differ based on the plan.

3. Plan-Specific Differences

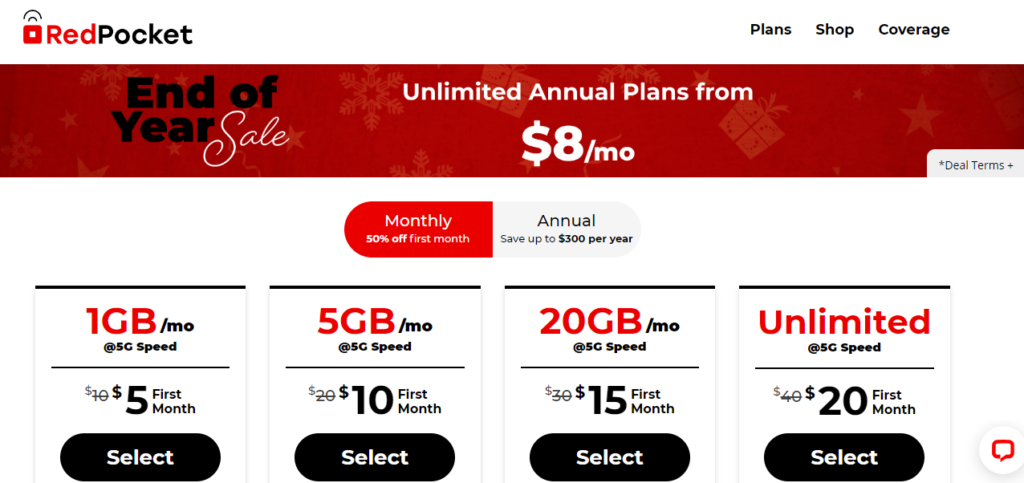

Where you purchase your plan can impact fees. An annual eBay plan might include just your regular sales tax.

Conversely, an annual plan from Red Pocket’s website may have additional fees and taxes, which could potentially be lower than what you would pay through eBay.

Here’s a breakdown of what you might see on your bill:

- State Sales Tax: Varied percentage based on state regulations.

- Regulatory Recovery Fee: Fixed or variable charge for recovering regulatory-related costs.

- Plan Cost: The advertised monthly rate for your chosen plan.

Remember, these charges are separate from the plan’s base cost and will affect the total amount you pay for your mobile service.

It’s best to review the billing details provided by Red Pocket before purchasing the plan to have a clearer idea of the total cost.