Are you trying to make a payment through IRS Direct Pay only to find yourself stuck at a digital dead end?

This hiccup can be a major source of stress, especially with tax deadlines looming over your head.

In this article, we’ll break down the reasons why IRS Direct Pay might not be working for you and offer step-by-step solutions to get you back on track with your payments.

How to Fix IRS Direct Pay Not Working?

To resolve the issue of the direct payment on the IRS, you should check your payment status on the IRS and wait for a few moments, then check if it’s working or not. Additionally, try using different payment methods.

Down below, we have discussed the solution in step-by-step detail.

1. check your internet connection

If you’re encountering issues with IRS Direct Pay, the very first step should be to check your internet connection.

A stable and active internet connection is crucial for IRS Direct Pay to function properly.

Here are the steps to Check your internet connection:

- Turn off your router or modem, wait for a few seconds, and then turn it back on.

- If the problem persists, you can reset your network settings on your device. Go to the network settings menu and look for an option to reset or restart network settings.

- If you’re using Wi-Fi, try switching to a wired connection to rule out any potential wireless issues.

- Restart your router or modem to refresh the connection.

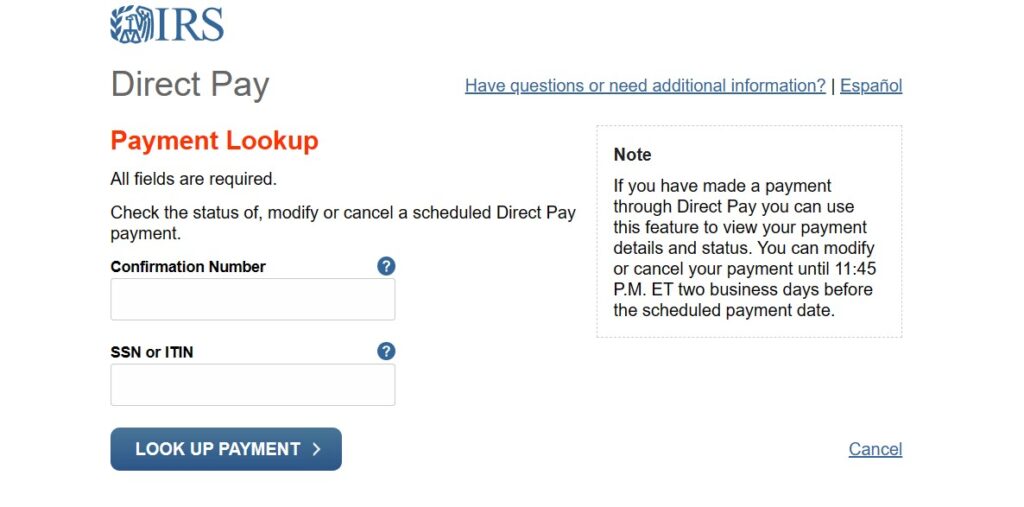

2. Check the payment status

It’s important to check the payment status by logging into your online IRS account.

Here you can confirm whether your payment has been acknowledged and processed by the IRS.

Even if the funds have not been immediately withdrawn from your bank account, you will receive credit for the payment on the date you specified, although the actual processing may take up to two business days.

To check the payment status through your IRS online account, follow these steps:

- Sign in to your IRS online account after two business days from the scheduled payment date.

- Access the Payment Lookup feature, and enter your confirmation number and SSN or ITIN to view and manage your payment details.

- Alternatively, log in to your IRS online account to check your entire payment history, including Direct Pay transactions.

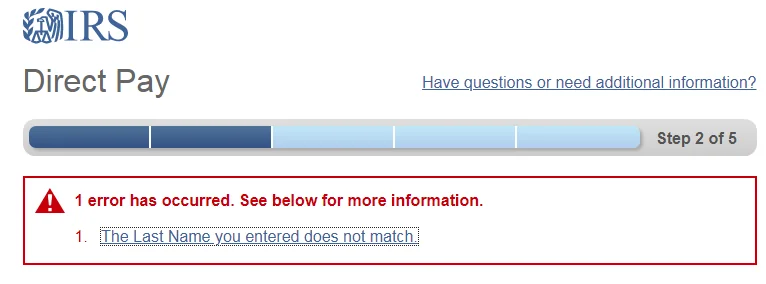

3. Verify Your Information

Ensure that all the information you entered is correct.

This includes your Social Security Number, the tax form number, and the tax period for the payment. Any discrepancies can cause the system to reject your payment.

To verify a Social Security Number (SSN), you can follow these steps:

- Use the Social Security Number Verification Service (SSNVS):

- Complete the necessary fields for each name and SSN you want to verify.

- Select the “Submit” button to process the data.

- Create or sign in with your ID.me account:

- Provide a photo of an identity document such as a driver’s license, state ID, or passport.

- Schedule an in-person validation appointment at a local UPS store:

- After verifying your identity in person, sign in to the Identity and Tax Return Verification Service to complete the process.

To verify your tax form number and tax period, you can follow these steps:

- Find the tax form number and tax period on your tax documents.

- Ensure the tax form number corresponds to your filing (e.g., 1040 for individual income tax) and that the tax period reflects the year you are filing for.

- If you find any mistakes, correct them before submission.

4. Wait for a few days

If you’ve recently initiated a payment using IRS Direct Pay and it’s not showing up immediately, be patient as transactions don’t always reflect instantly in your online account.

It’s not uncommon for there to be a delay in the display of the payment status.

If you are still uncertain after checking, give it a few days and then verify again to see if the transaction has been processed and appears in your account.

5. Try a Different Payment Method

If Direct Pay is still not working, consider alternative payment methods offered by the IRS, such as paying by debit or credit card, or using the Electronic Federal Tax Payment System (EFTPS).

While these options may have different processes or fees, they can serve as a backup when Direct Pay is not available.

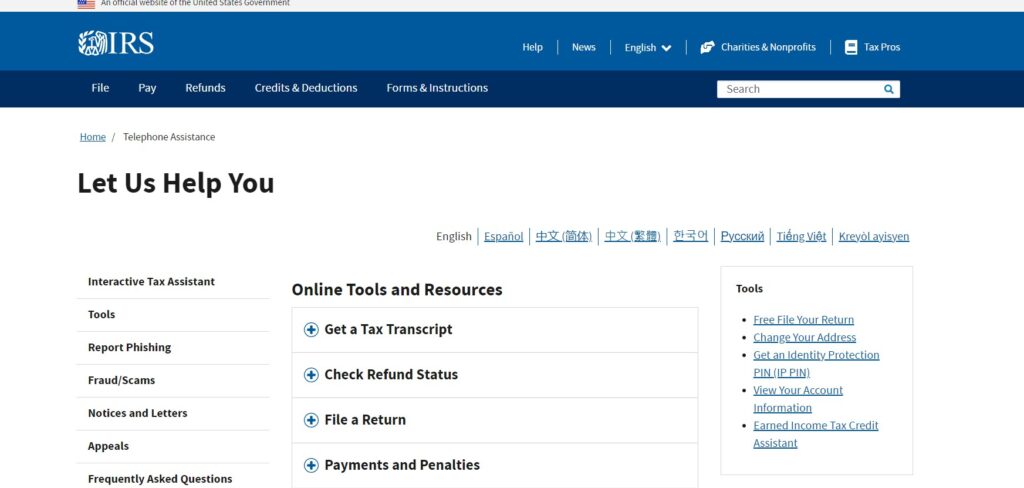

6. Contact the IRS

If you have tried all the above steps and still cannot make a payment using Direct Pay, you can contact the IRS for assistance.

The IRS e-file Payment Services are available 24/7 at 888-353-4537 to inquire about or cancel a payment.

However, keep in mind that it is recommended to wait 7 to 10 days after your return has been accepted before calling.