Zelle is a widely-used payment service that allows swift money transfers directly between U.S. bank accounts.

However, sometimes users experience issues such as a funded Zelle payment that hasn’t been received.

This guide will delve into the possible reasons for this issue and provide detailed resolutions.

Why is the Zelle Payment Funded but Not Received?

Zelle payments may be funded but not received due to various reasons including incorrect recipient details, extended bank processing times, technical issues, the recipient’s bank account status, or exceeding Zelle’s transfer limits.

Reasons And Fix For Zelle Payment Funded but Not Received?

To fix the issue of funded but not received Zelle payments, ensure the recipient’s details are accurate, allow for bank processing times, address technical issues with Zelle or your bank’s support, verify the recipient’s account status, and adhere to Zelle’s transfer limits.

There are several reasons why your Zelle payment might be funded but not received. Here are the most common ones:

1. Incorrect Recipient Information

One potential reason could be inaccurate recipient information. If the receiver’s email address or U.S. mobile number linked to Zelle is incorrect, the funds may not be delivered.

Fix:

Step 1: Confirm the Recipient’s Information

- Verify the recipient’s details in your Zelle account.

- Navigate to your past transactions and click on the payment in question.

- Check the email address or mobile number you’ve entered.

Step 2: Re-initiate the Transfer

- If there is an error, correct the recipient’s information in the ‘Send Money’ section.

- Reinitiate the transfer with the correct details.

2. Bank Processing Time

Every bank or credit union has specific processing times. If your bank or the recipient’s bank takes longer to process payments, the funds may not appear immediately in the recipient’s account.

Fix:

Step 1: Enquire About the Transfer Timeframe

- Call your bank’s customer service line or visit their website to understand their specific processing times.

- Keep in mind that while Zelle transactions typically occur within minutes, some banks may take up to 2 business days.

Step 2: Wait for Processing to Complete

- If the delay is within the stated timeframe, wait patiently for the transfer to complete.

3. Technical Glitches

Like any other digital platform, Zelle may occasionally face technical glitches or temporary service disruptions, delaying transactions.

Fix:

Step 1: Contact Customer Support

- Reach out to Zelle’s customer service at 00 1 501-748-8506 or you can do this by visiting the ‘Help‘ section on their website or through their mobile app. You may also contact your bank’s customer support.

Step 2: Wait for Issue Resolution

- If Zelle is experiencing technical issues, you might have to wait for them to resolve the problem before your transaction can be completed.

4. Receiver’s Account Status

If the receiver’s account linked to Zelle is inactive, suspended, or has some restrictions, the transaction may not be successful.

Fix:

Step 1: Verify Receiver’s Account Status

- Ask the recipient to check the status of their bank account. They can do this by logging into their online banking portal or contacting their bank’s customer support.

Step 2: Reattempt the Transfer

- Once the receiver’s account issues have been resolved, try initiating the transfer again.

5. Transfer Limits Issue

Both Zelle and your bank or credit union may set limits on the amount of money you can send within a certain timeframe. If your transfer exceeds these limits, the transaction might not go through.

Fix:

Step 1: Review Zelle and Bank Transfer Limits

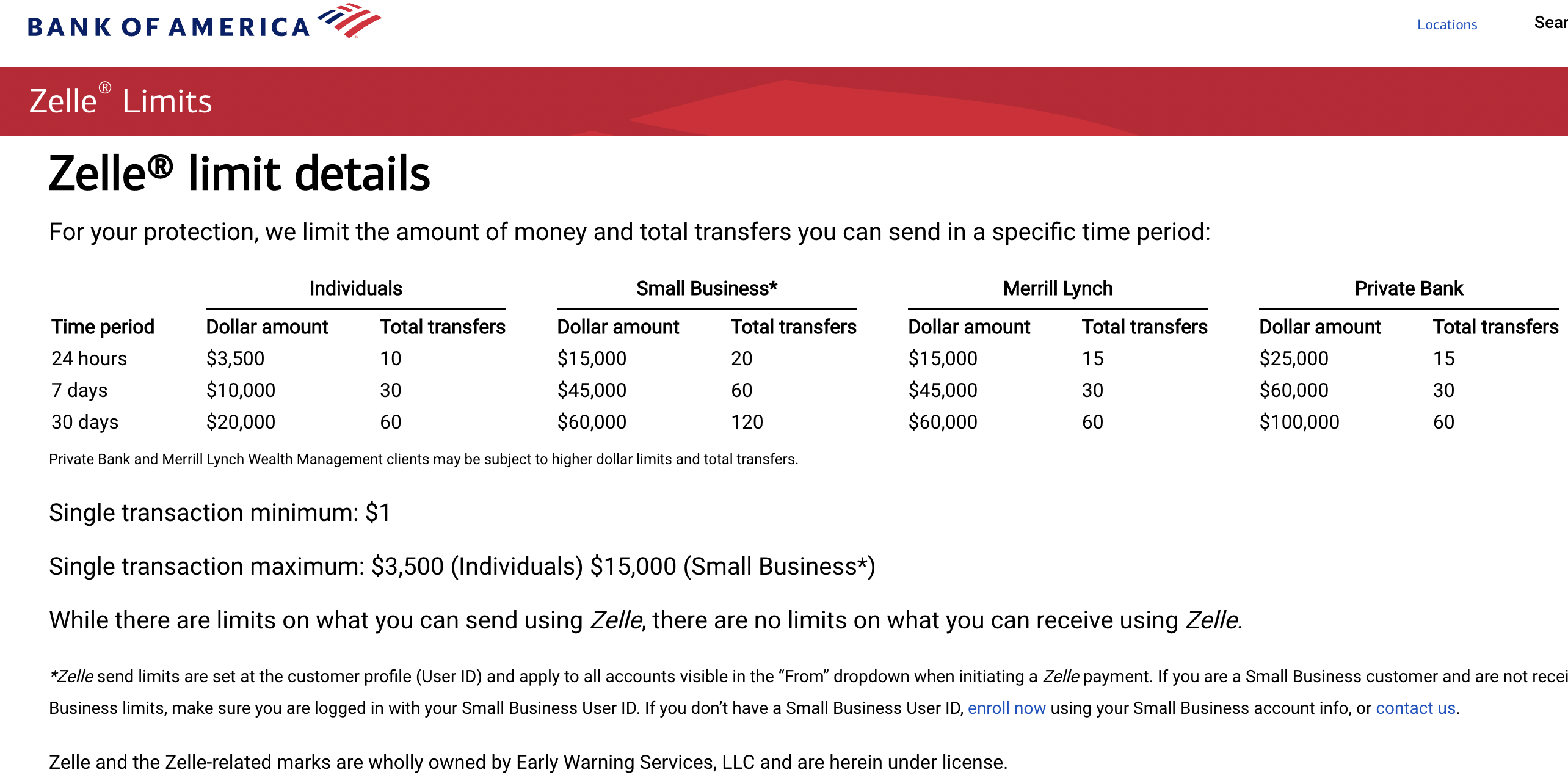

- Check Zelle’s transfer limits, which can typically be found in their FAQ section. The transfer limit with Zelle is usually $500 per week unless your bank offers a higher limit.

- Also, check your bank’s policies on money transfers.

Step 2: Adjust the Transfer Amount

- If your transfer amount is above the allowed limit, adjust the amount accordingly. If necessary, you may have to split your transfer into multiple transactions to remain within the set limits.

how to fix zelle payment funded but not received chase issue?

If your Zelle payment is funded but not received through Chase Bank, ensure you have the correct recipient details, try to fix technical glitches with help of Chase support, confirm the recipient’s Chase account status, know the Chase Bank’s specific processing times, and last but not least, respect the Chase’s Zelle transfer limits.

How to Fix bank of america zelle not working Issue?

Verify your Zelle enrollment status with Bank of America by contacting their customer support. Also ensure to use the latest version of the Bank of America mobile app. If the problem persists, reinstall the app or contacting customer support for further assistance.

FAQs

Zelle Payment Pending For How Long?

Zelle payments typically complete within minutes. However, if the recipient is not yet enrolled with Zelle, the payment could remain pending for up to 14 days.

After this period, if the recipient has not enrolled, the payment will be canceled, and the funds will return to the sender’s account.

Zelle Funded VS Completed

A Zelle payment status is marked as “Funded” when the funds have been deducted from the sender’s account but the transfer to the recipient’s account is still in progress.

On the other hand, a status of “Completed” indicates that the transfer process has been fully executed and the funds have been successfully deposited into the recipient’s account.

Does Zelle Work on Weekends?

Yes, while Zelle itself operates 24/7, its functionality is tied to the operating hours of your bank.

Zelle transactions initiated on non-business days, including weekends and holidays, may experience delays as banks typically process transactions only on business days.

Does Zelle Work on Holidays/Vacations?

Yes, Zelle works on holidays and during vacation periods. However, the speed of transactions may depend on your bank’s operating procedures, as banks often do not process transactions on non-business days, which include holidays.

So while you can initiate a Zelle transfer anytime, the actual transfer might be processed on the next business day.

Does Zelle Work on Weekends Bank of America?

Yes, Zelle does work on weekends for Bank of America account holders. However, while Zelle is designed for near-instant transfers, transactions could potentially be delayed due to the bank’s operating schedule, as banks often process transactions on business days.

We would recommend to always check with Bank of America’s specific policies for confirmation.

What is Bank of America Zelle Limit For Business?

For small business accounts with Bank of America, the Zelle transaction limits are as follows: Within a 24-hour period, you can send up to $15,000 through Zelle with a maximum of 20 transactions.

Over a 7-day period, the limit increases to $60,000 with a total of 120 transactions. These limits provide businesses with ample flexibility for their transaction needs.

What is The Highest Zelle Limit?

According to the official information provided by Zelle, the highest Zelle limit is determined by individual banks or credit unions.

It is recommended to directly contact your bank or credit union to obtain specific details about their sending limits for Zelle transactions.

If your financial institution does not offer Zelle, the weekly send limit through the Zelle app is set at $500, and it is not possible to request an increase or decrease in this limit.

Are There International Fees With Zelle?

No, Zelle is a domestic payment service within the United States and does not support international transfers.

As a result, there are no international fees associated with Zelle transactions. It is designed specifically for transfers between U.S. bank accounts.

Conclusion

While Zelle offers an effective and quick method for transferring money between U.S. bank accounts, it’s not immune to issues.

One such issue involves situations where the payment is funded but not received by the intended recipient could be caused by several factors including incorrect recipient information, bank processing times, technical glitches, the recipient’s account status, or transfer limits.