When you pay for your phone service with Spectrum Mobile, you might notice some extra charges on your bill. These are taxes and fees that the government or phone company adds.

The amount you pay can change depending on where you live and how much you use your phone.

This article will talk about these extra costs from Spectrum Mobile so you know what to expect on your bill.

What are Spectrum Mobile Taxes and Fees?

When examining your Spectrum Mobile bill, you’ll find various taxes and fees that are mandated by federal, state, and local authorities, as well as Spectrum Mobile itself. These can affect the total amount you pay each month.

1. Spectrum Mobile Bill

Your Spectrum Mobile bill includes not only the cost of your phone plan but also additional taxes and fees that may not be immediately apparent when you first sign up.

Detailed on your statement, these extra charges are critical in understanding the full cost of your service. For a comprehensive breakdown of the possible fees, Spectrum’s website provides an overview of each fee you might encounter.

2. Federal, State, and Local Taxes

On top of your basic service rate, federal, state, and local taxes apply to your Spectrum Mobile service. These may include sales tax, utility tax, and communications tax, depending on your location.

The specific rates and types of taxes charged can vary, which is why your bill might be different from someone in another state or even a different municipality.

3. Mandatory Fees and Charges on Spectrum Mobile

Spectrum Mobile’s mandatory fees normally comprise regulatory costs and surcharges, such as the Federal Universal Service Charge, which all telecommunications services charge to fund national telecommunications programs.

Other potential charges include a 911 service fee and cost recovery charges, intended to cover legal and administrative expenses incurred by the provider.

Detailed Breakdown of Spectrum Mobile Taxes

When examining your Spectrum Mobile bill, you’ll notice several taxes that contribute to the total amount due. Understanding these charges can help you better manage your mobile expenses.

1. Federal Universal Service Fund

The Federal Universal Service Fund (FUSF) fee is a mandatory contribution regulated by the Federal Communications Commission (FCC).

This fee ensures that people across the United States have access to affordable telecom services. Your FUSF charge is calculated as a percentage of your interstate and international telecommunications charges.

2. Telecommunications Relay Service Fund

Another fee listed on your bill is for the Telecommunications Relay Service Fund. This fund supports relay services for individuals with hearing or speech disabilities, enabling them to communicate over the phone.

The cost is a federally administered charge and varies quarter to quarter.

3. State Sales Tax

You’re also required to pay State Sales Tax, which is dependent on the state where you reside.

Some states have higher sales taxes on telecommunications services, which can significantly impact your bill’s total.

4. District and City Taxes

Your bill includes District and City Taxes, which are specific to your local jurisdiction.

These taxes fund various municipal services and can vary depending on city and district rates.

What are Spectrum Mobile Fees?

When choosing Spectrum Mobile, you’ll encounter various fees that are standard across many mobile carriers.

These include the Regulatory Recovery Fee, Administrative Fee, and a one-time Activation Fee for new lines of service.

1. Regulatory Recovery Fee

Regulatory Recovery Fee is a charge you see on your bill that helps Spectrum Mobile recover the cost of federal compliance.

This fee is not government-mandated but allows the carrier to cover the expenses associated with governmental regulations.

2. Administrative Fee

The Administrative Fee is a monthly charge imposed by Spectrum Mobile to help offset the costs of administration and maintenance of their network infrastructure.

Like the Recovery Fee, this is not a government-imposed cost but rather an operational expense passed on to customers.

3. Activation Fee

For new Spectrum Mobile customers, there is a one-time Activation Fee. This fee covers the cost associated with setting up a new line of service with Spectrum Mobile.

According to industry reviews, this fee is commonly a one-time $10 charge per line when you activate your service.

What are the steps to calculate Spectrum mobile Taxes And Fees?

Below are the steps to help you in calculating the taxes and fees in Spectrum Mobile.

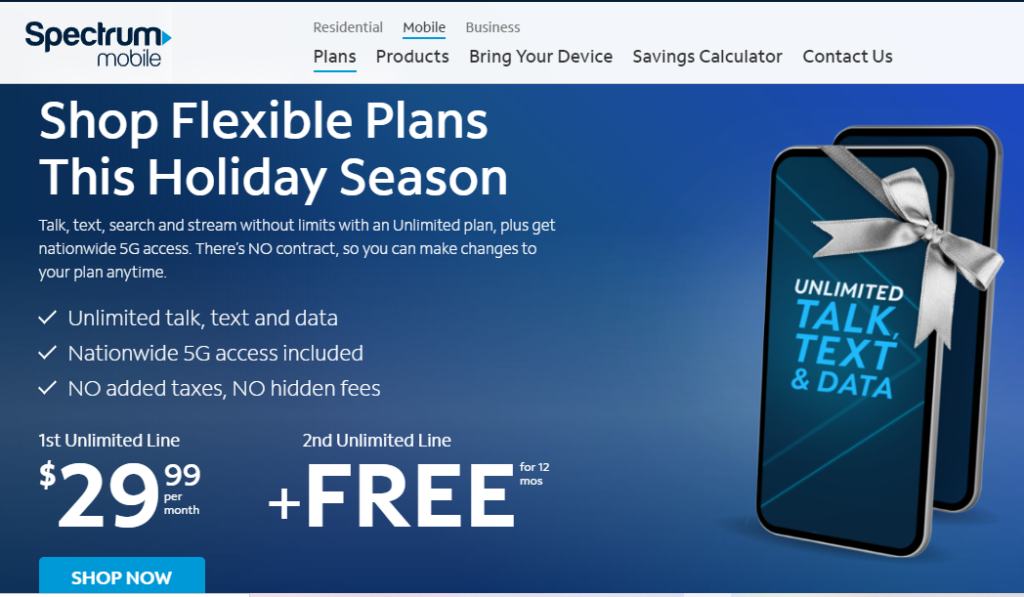

1. Choose a Plan

Start by selecting the Spectrum Mobile plan that suits your needs, whether it’s a pay-per-gigabyte plan or an unlimited data plan. The base cost of the plan will be the starting point for calculating your total bill.

2. Use the Savings Calculator

Spectrum Mobile provides a Savings Calculator that can help you estimate your savings, which may include the calculation of taxes and fees based on the information you provide.

3. Add Device Costs

If you purchase a device through Spectrum Mobile, sales tax will be charged for the device or accessories. This tax is based on the full price of the products purchased.

4. Review Your Bill

For a detailed breakdown of your bill, including taxes and fees, you can refer to Spectrum Mobile’s guide on Understanding Your Spectrum Mobile Bill, which notes that taxes, fees, and other charges related to services are included in the price of the data plan you choose.

5. Account for Local Taxes and Fees

Remember that specific tax rates can vary based on your location as local sales tax, and government fees might apply. These are typically calculated at checkout or on your monthly bill.

6. Check Promotions or Discounts

If you are using any promotions or discounts, these might affect the final amount of taxes and fees since they can change the base amount on which taxes are calculated.

FAQs

1. Why Are My Taxes and Fees High?

Your Spectrum Mobile bill includes not only the cost of your phone plan but also a variety of governmental taxes and fees.

These can include the Federal Excise Tax, which is a percentage of your telecommunications monthly bill, and may also encompass state and local charges.

The rates can vary based on where you live and the services you use, resulting in higher overall fees on your bill.

2. Can Spectrum Mobile Taxes and Fees Change?

Yes, the taxes and fees on your Spectrum Mobile account can change. These adjustments are usually driven by changes in government tax rates or the imposition of new local fees.

Spectrum Mobile doesn’t control these taxes and fees, so any changes made by legislative or regulatory actions can be reflected in your monthly bill.

3. How to Find Tax and Fee Information on My Bill?

To locate the detailed breakdown of the taxes and fees on your Spectrum Mobile bill, navigate to the billing section of your account either online or on your paper bill.

Here, you’ll find a list of all the charges under the taxes and fees section. This can include state and local taxes, regulatory fees, and other charges, allowing you to see exactly what you’re being charged each month.