Are you a Navy Federal Credit Union member with a credit card that has been declined, even though you have sufficient funds in your account?

It’s a common situation that many cardholders face, and it can be quite confusing and frustrating.

In this article, we’ll guide you through the process of resolving a declined credit card situation with Navy Federal Credit Union, including steps to take and potential reasons for the decline.

How to Fix navy federal credit card declined but have money Issue?

To resolve the credit card decline issue on Navy Federal, you should check your credit limit and update your billing information.

Down below, we have discussed the solution in step-by-step detail.

1. Check Your Credit Limit

One of the most common reasons for a credit card to be declined is that you’ve reached your credit limit.

Even if you have money in your bank account, your credit card has a separate limit.

If you’re not sure what your limit is or whether you’ve reached it, check your latest statement or log in to your Navy Federal account to verify.

2. Review Your Account for Holds or Blocks

Sometimes, a temporary hold can be placed on your card, such as when you rent a car or book a hotel room.

These holds can reduce your available credit. Additionally, Navy Federal may block your card if they suspect fraudulent activity.

If you suspect a hold or block, contact Navy Federal at 1-888-842-6328 to inquire about the status of your card.

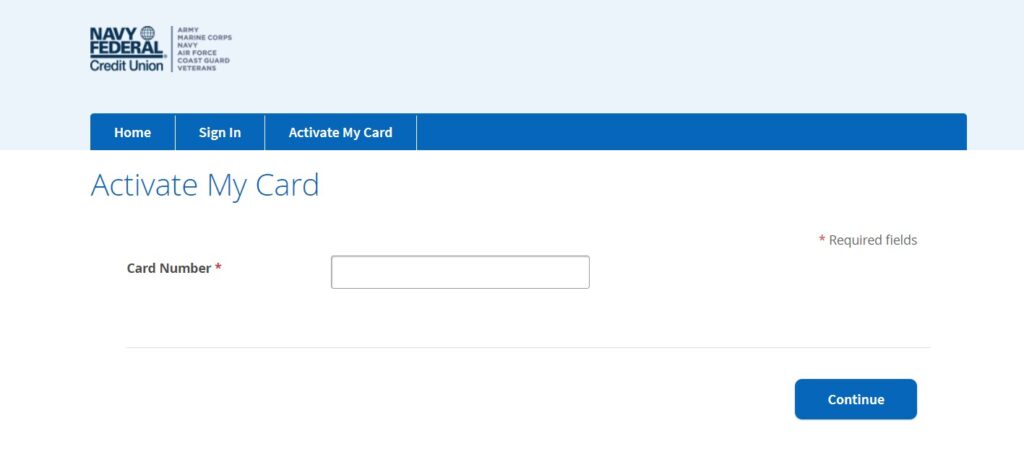

3. Ensure Your Card is Activated

If you’re using a new card, make sure it has been activated. Cards that aren’t activated will be automatically declined.

Activation can typically be done online or over the phone.

To ensure your Navy Federal Credit Union card is activated, you can follow these general steps:

- Visit the Navy Federal Credit Union activation website: Navy Federal Activation Website

- Enter the required information, which may include your card number, name, and other identifying details.

- Follow the prompts to complete the activation process.

5. Update Your Billing Information

If your billing information is not up to date, transactions may be declined.

This can happen if you’ve recently moved or changed your personal information.

Make sure all your details are current with Navy Federal.

To update your billing information with Navy Federal Credit Union, follow these steps:

- Sign in to your Navy Federal online banking account.

- Navigate to the “Accounts” section.

- Select the account associated with your credit card.

- Look for the “Billing Information” section.

- Update your billing information as needed, including your address, phone number, and email address.

- Save your changes.

6. Check for International Restrictions

If you’re traveling abroad or making purchases from international vendors, your card may be declined due to Navy Federal’s security measures.

Before traveling or making an international purchase, notify Navy Federal to ensure your card will work without issues.

To check for international restrictions and ensure your Navy Federal Credit Union card will work without issues when traveling or making international purchases, follow these steps:

- Sign in to your Navy Federal online banking account.

- Navigate to the “Travel Notifications” section.

- Select the account associated with your credit card.

- Update your travel information as needed, including your destination, departure date, and length of stay.

- Save your changes.

7. Contact Navy Federal for Assistance

If none of the above steps resolve the issue, you may need to speak directly with Navy Federal Credit Union.

They can provide specific information about why your card was declined and help you fix the problem.

You can reach them at their customer service number, which is typically listed on the back of your credit card or their official website.