CRA (Canada Revenue Agency) is the Canadian federal government service which oversees the collection of tax and governs law and policy related to tax.

It is also responsible for the registration of charities in Canada and for providing tax credits and benefits.

CRA is headquartered in Ottawa and is one of the largest organisations based on several employees. It also enforces the tax laws in the country.

Every year a business or individual is required to file for an income tax return which decides if they owe taxes and their amount or if they will get a refund.

This has been made easy by using the online CRA service where you need to create a CRA account.

But you may want to delete your CRA account for reasons like you may not need the CRA services or you need a new account. In that case, you can delete your existing CRA account.

This article will discuss the reasons to delete a CRA account and how to delete your CRA account.

Reasons To Delete Your CRA Account

You may want to delete your existing CRA account for the following reasons:

- You don’t need CRA services anymore.

- You found a new job and no longer want to continue the existing CRA account.

- There is a problem with your existing CRA account.

- You no longer need a CRA account.

How To Delete Your CRA Account?

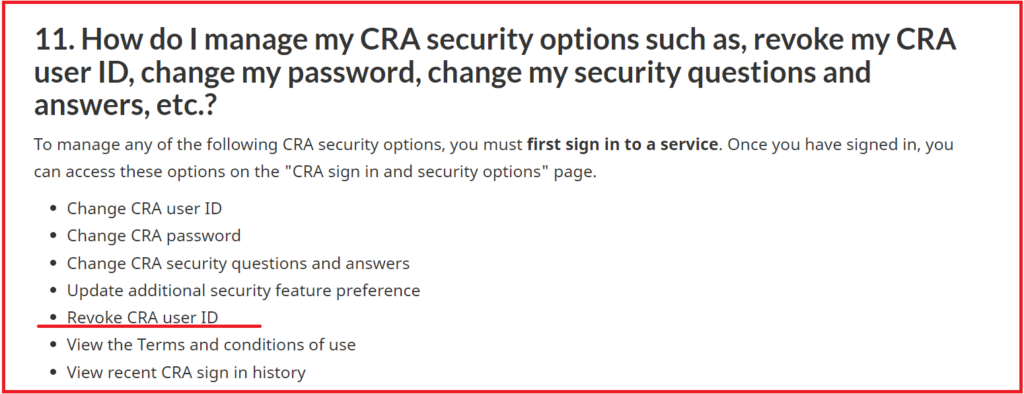

To delete your CRA account, log in on the CRA website, go to “CRA Login and Security Options,” select “Revoke CRA User ID,” re-enter your password, and confirm.

To delete your CRA account follow the steps mentioned below.

- Open the CRA website.

- Click on login and select the option to log in to your account.

- Enter your credentials to sign in. After you sign in you will be directed to a “CRA Login and Security Options”.

- On that page, click on the “revoke CRA User ID” link.

- Another page will open that will ask you to re-enter your password.

- After you enter the password, click on the “Revoke” button to confirm.

The steps will help you cancel your CRA account and you will not be able to use your User ID with the CRA sign-in services.

What To Do Before Closing CRA Account?

The same credentials are used to access both individual and business CRA accounts.

For an individual account, ensure that you have cleared all your dues with the CRA. But if your business has been cancelled you can notify the CRA officials about the same so that the tax account can be closed.

Remember to complete all your required forms before closing the CRA business account. Close the business number and all CRA business accounts after you clear what you owe and final tax returns.

You also need to close your GST/HST account you can do it by accessing your CRA business account.

When you decide to permanently dissolve your business send a copy of the dissolution to the CRA or else a tax return will need to be filed every year even if there are no liable taxes.

You can reach out to the CRA Support team by calling on 1-855-330-3305 for individual-related issues and call 1-800-959-5525 for business-related queries.