Are you facing issues with making mobile deposits through your Chase account? It can be frustrating when you encounter difficulties with essential banking functions.

However, there are various solutions to address this problem and ensure that you can conveniently deposit checks using the Chase mobile app.

In this guide, we’ll explore the common reasons behind the “Chase Not Available for Mobile Deposit” issue and provide practical steps to resolve it.

How To Fix Chase Not Available For Mobile Deposit?

You should validate the daily deposit limit and your account eligibility, update the app, and verify your internet connection.

Below is a detailed explanation of all the above-mentioned fixes:

1. Check The Daily Deposit Limit

If you have recently used the QuickDeposit feature within the Chase mobile app, it’s important to consider the possibility that you may have reached the daily deposit limit.

Chase, like many other financial institutions, imposes daily limits on the amount of funds that can be deposited using mobile deposits.

If you encounter the “Chase Not Available for Mobile Deposit” message after a recent deposit, it’s advisable to verify whether you have exceeded the daily deposit limit.

To review your account’s mobile deposit limits with Chase, you can follow these steps:

- Open the Chase mobile banking app on your smartphone or tablet.

- Once logged in, navigate to the section of the app that allows you to make a mobile deposit. This is typically found within the “Deposit” or “Move Money” section of the app.

- Look for an option or link within the mobile deposit section that provides details about deposit limits. This may be labeled as “View Limits,” “Deposit Limits,” or a similar description.

- Click on the appropriate link or option to access information about your account’s mobile deposit limits. The app should display details such as your daily, weekly, or monthly deposit limits.

- Additionally, it may provide information about any specific restrictions or requirements related to mobile deposits for your account.

2. Check Your Account Eligibility

Different types of Chase accounts may have varying eligibility criteria for mobile deposits. Some accounts may require a certain minimum balance, a specific account type, or a history of account activity to qualify for mobile deposits.

It’s important to review the terms and conditions of your account or contact Chase customer support to confirm your account’s eligibility for mobile deposit.

If your account is not currently eligible, you may need to consider upgrading to a different account type that supports mobile deposit.

To check the eligibility of your account for specific features, follow these steps:

- Go to the official Chase website at www.chase.com.

- Look for the section related to account features, requirements, or frequently asked questions. This section may be labeled as “Account Eligibility,” “Account Features,” or something similar.

- Within the relevant section, review the eligibility criteria for the specific feature you are interested in, such as mobile deposit.

The information provided on the website will outline the account types that are eligible for mobile deposit and any associated requirements.

3. Update The Chase Mobile Banking App

Keeping the Chase mobile banking app up to date is crucial for ensuring compatibility with the latest features and security enhancements.

To update the app, navigate to the app store on your device (such as the Apple App Store or Google Play Store), search for the Chase mobile banking app, and install any available updates.

Newer app versions often include bug fixes and improvements that can address issues related to mobile deposit functionality.

4. Verify Internet Connection

A stable and reliable internet connection is essential for conducting mobile deposits. If you are experiencing issues with mobile deposit, check your device’s internet connectivity.

If using Wi-Fi, ensure that you are connected to a strong and stable Wi-Fi network. If using cellular data, verify that your device has sufficient signal strength.

Inadequate internet connectivity can lead to errors when uploading check images or transmitting deposit data to Chase’s servers.

5. Ensure Proper Check Imaging

When capturing images of the front and back of the check for mobile deposit, it’s important to ensure that the images are clear and legible.

Place the check on a contrasting background to enhance visibility, and avoid capturing images in dimly lit environments.

Adequate lighting can significantly improve the quality of the check images, making it easier for the mobile deposit system to process the deposit accurately.

6. Endorse the check

Before attempting a mobile deposit, make sure to endorse the check as required by Chase’s mobile deposit guidelines.

Endorsing the check typically involves signing the back of the check with your signature. Some mobile deposit rejections occur due to missing or incorrect endorsements.

Double-check that you have endorsed the check properly before initiating the deposit process.

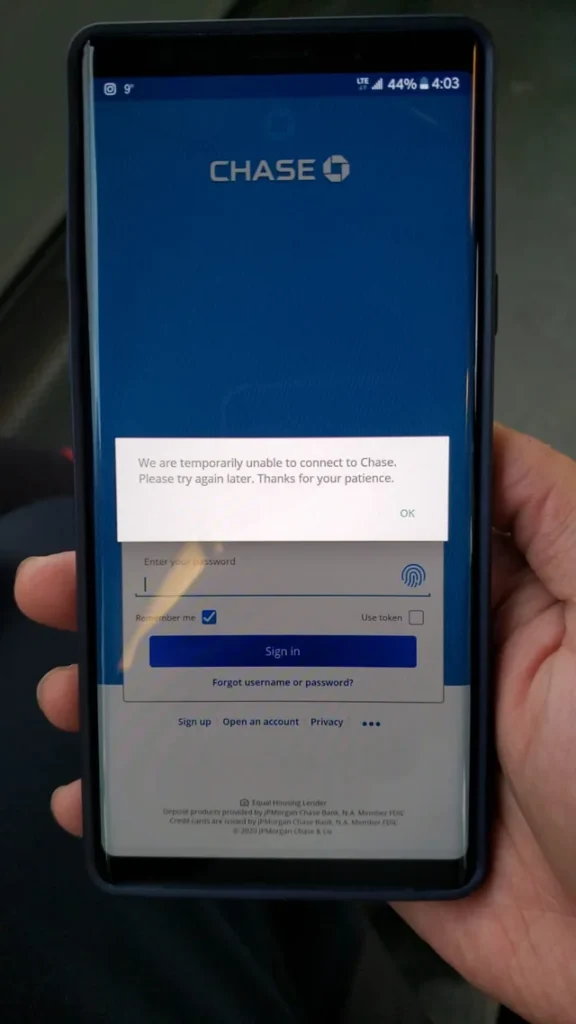

7. Consider App Hiccups

Occasionally, temporary app hiccups or system glitches may cause interruptions in the mobile deposit functionality.

In such cases, it’s advisable to wait for a short period and attempt the mobile deposit again later.

Additionally, if other users are reporting similar issues with the Chase mobile app, it may indicate a broader technical issue that Chase is working to resolve.

Monitoring official Chase communications or support channels can provide insights into any known app-related issues and their resolution timelines.

To contact Chase customer support, you can follow these steps:

- Call Chase Customer Service:

- Dial the Chase customer service phone number at 1-800-935-9935 to ask about your query to them.

- Chase Social Media Platforms:

- Chase may provide customer support through social media platforms. You can reach out to them via direct message or by commenting on their official posts for assistance.