When it comes to managing your finances, overdraft fees can be an unexpected expense that can disrupt your budget.

Like many banks, Chase has policies for when customers overdraft their accounts.

However, they also offer ways to have these fees waived, which can be a financial relief. Here’s a comprehensive guide on how much you can save and how to claim Chase overdraft forgiveness.

What is The Chase Overdraft Fees and How It Works

Chase Bank charges a $34 overdraft fee for each transaction that overdraws your account balance by more than $50.

Chase limits the overdraft fees to three per day, meaning the maximum overdraft fees charged in a single day could be $102. By having these fees waived through the methods provided by Chase, you can save this amount.

Chase Policy Against ACH Transaction

If you have enough funds during the time of automatic transfer, you can save NSF and overdraft fees i.e. $68.

If Chase has insufficient payment against the ACH cheque, Chase will charge you a Non-Sufficient Funds (NSF) fee of $32 for the declined payment.

However, if you present the same ACH for payment again, Chase will transfer the amount despite having insufficient funds in the Chase account. In return, you will be charged an Overdraft fee.

Moreover, if you have a good account standing, you can reach out to Chase and request a refund of $68.

When Chase Overdraft fees Can be Waived

Chase waves overdraft fee in the following scenario:

- No overdraft fee will be charged if your account balance is overdrawn by $50 or above at the end of the business day.

- No Overdraft charges for the transactions below $5.

- Chase may automatically waive an overdraft fee, especially if the account is brought back to a positive balance promptly.

Chase May Quick Consider Waiving The Fee During Following Scenario:

- If this is your first time incurring an overdraft fee, Chase may waive it as a one-time courtesy.

- If you deposit to cover the overdraft amount shortly after incurring the fee, Chase may consider waiving the fee.

You can ask for A refund in the following scenario and you will have a high possibility that Chase may waive:

- Notices unauthorized transactions in error.

- An issue with Chase ATM while the transaction

- If a merchant charges you incorrectly, fails to deliver goods or services, or you return an item and the merchant does not process a refund

- Charged for services you did not use or agree to

- Charged more than once for the same transaction

- Closed an account with a remaining balance

- Did not receive the correct rewards or cash back amount as part of a promotion or offer,

- Your account remains overdrawn for an extended period and you are charged additional fees,

- You are charged an inappropriate NSF fee.

How To Claim Chase Overdraft Fee Waive

You can claim Chase overdraft bee by Directly Contacting the Chase representatives. Before getting into customer service, keep in mind that you should have Good account standing.

If you are a new customer and this is your first overdraft, Chase may be willing to waive the fee as a one-time courtesy. Also, Customers with a positive banking history may have more leverage in having fees waived.

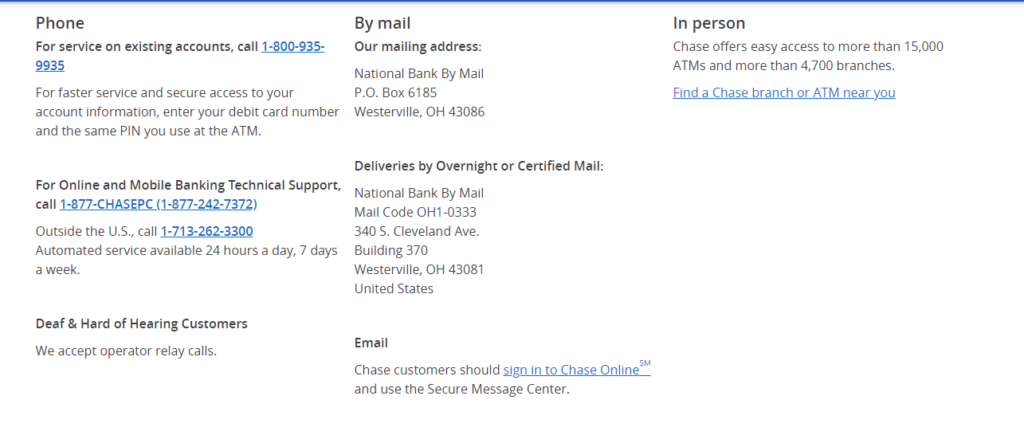

Reach out to Chase by calling their customer service line. Explain your situation and request that the overdraft fee be waived. You can reach out to them either by mail or call.

You can also visit a Chase branch and speak to a banker in person about waiving the fee.

To speak directly to customer service:

- Confirm the transaction status in your Chase account.

- Gather receipts, confirmations, or related correspondence.

- Call Chase customer service to initiate a dispute with supporting evidence.

- Monitor your account for updates.

- Follow up with Chase and document all interactions.

- Verify that any reversed fees are reflected in your account if the dispute is successful.

How To Avoid Overdraft Fee Using The Overdraft Protection

It is up to you whether to enable overdraft protection or not. You can enable it by linking your savings account so that the amount will be automatically transferred from the account and you will be saved from the Overdraft fee. It includes linking savings accounts and Setting up alerts.

1. Link Saving Account To Chase’s Checking Account

You can link your Chase savings account to your checking account for Overdraft Protection. If you overdraw, funds will be transferred from savings to cover the shortfall.

To manage overdraft protection settings for a Chase Debit Card, you would typically need to follow these steps:

Through the Chase Mobile App:

- Open the Chase mobile app on your smartphone.

- Sign in to your account using your credentials.

- Navigate to the ‘Account Services‘ or ‘Settings‘ section of the app.

- Look for ‘Overdraft Protection‘ or a similar term.

- Follow the prompts to link or unlink your debit card to overdraft protection. This may involve selecting a backup funding source like a savings account.

Through the Chase Website:

- Visit the Chase website and log in to your account.

- Locate the ‘Checking Accounts‘ section or similar.

- Find the ‘Overdraft Protection‘ options.

- You may see an option to ‘Manage Overdraft Protection‘ or ‘Debit Card Coverage.’

- Choose to enrol in overdraft protection by linking a backup account or opt-out/unlink your account from the service.

2. Setting Up Overdraft Alerts In Chase

Enrol in account alerts to be notified when your balance is low.

To set up these alerts:

- Sign into your Chase account and Go to the “Account Management” tab.

- Choose “Profile & settings,” and Click “Alerts”

- Select “Choose alerts” and pick the accounts you want.

- Customize your alert: You can set a low balance alert to notify you when your account falls below a certain dollar amount.

- Choose your Delivery method: You can select a notification according to your convenience (email, text message, or push notifications through the Chase mobile app).

- Click “Save”