Are you one of the many Chase bank customers who rely on direct deposit to receive their paychecks, only to find that the funds haven’t shown up in your account?

It can be a frustrating and stressful situation, especially if you’re counting on that money to pay bills or cover expenses.

But don’t worry, there are steps you can take to fix the issue and get your direct deposit working properly again.

In this article, we’ll go over some reasons why Chase direct deposit may not be showing up, and provide you with actionable tips to resolve the issue.

How To Fix Chase Direct Deposit Not Showing Up?

To fix the issue of Chase direct deposit not showing up, you should check with your employer, verify your account information, re-enroll in direct deposit, and wait for a while in case direct deposit is delayed. Moreover, you may also check Chase’s direct deposit limit, and contact the customer service of Chase.

Below is a detailed explanation of all the above-mentioned fixes:

1. Check with your employer

The first step is to confirm that your employer has actually sent the direct deposit to Chase.

Reach out to your employer’s payroll department and ask them to confirm that they have sent the deposit to the correct account. If they have not yet sent the deposit, ask when you can expect it to be sent.

If they have sent the deposit, ask for the date and amount of the deposit, and confirm that the account information they have on file matches your Chase account information.

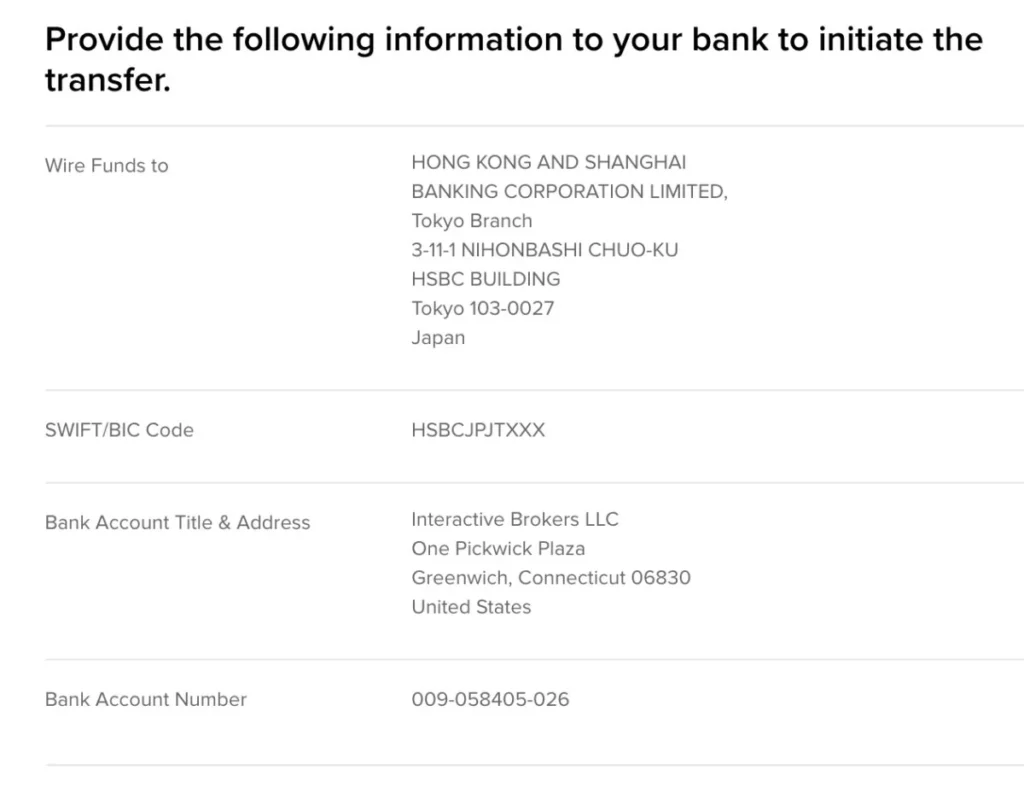

2. Verify your account information

If your employer has confirmed that they have sent the deposit, the next step is to verify that the account information you provided to them matches your Chase account information.

To do this, log in to your Chase account online or through the mobile app.

Navigate to the “Direct Deposit” section and check that the account and routing numbers (a nine-digit code used to identify a financial institution in a transaction) listed under your account details match the information you provided to your employer.

If there is a discrepancy, update your account information and notify your employer.

3. Re-enroll in direct deposit

If your employer has confirmed that they have sent the deposit and your account information is correct, you may need to re-enroll in direct deposit.

To do this, log in to your Chase account and navigate to the “Direct Deposit” section. Follow the prompts to re-enroll and ensure that your employer has the correct account information.

4. wait for a while

If your direct deposit is delayed, it’s best to wait for a while as it may take some time for the funds to be processed and deposited into your account.

Direct deposits are typically processed overnight but may take longer to appear in your account depending on the timing of the deposit and other factors.

If the delay persists for more than a few days, you can try contacting your employer or Chase customer service for further assistance.

5. Check Chase’s direct deposit limit

If you are having trouble with your direct deposit not showing up, it’s possible that the issue may be related to your Chase direct deposit limit.

To check your limit, log in to your Chase account online or through the mobile app and navigate to the “Direct Deposit” section.

The exact limit may vary depending on the type of account you have and the specific terms and conditions of your account.

If you have reached your direct deposit limit, you may need to wait until the next deposit period.

6. Contact Chase customer service

If the above steps don’t resolve the issue, it’s time to reach out to Chase customer service.

You can call their customer service line or use the secure message centre within your online account to contact a representative.

Explain the issue and provide any relevant information, such as confirmation from your employer that the deposit was sent.

The Chase representative will investigate the issue and work to resolve it as quickly as possible.