Are you not able to see the pending deposit list on Navy Federal?

Members of the Navy Federal Credit Union (NFCU) often rely on the visibility of pending deposits to manage their finances effectively.

Navy Federal not showing a pending deposit means probably your transaction process is cleared and the fund will be available on the next day or you might be checking earlier to the day of fund availability.

iIn this blog post let’s see common reasons why a pending deposit might not be showing up in an NFCU account and how to fix it.

Why Navy Federal Not Showing Pending Deposit

If your Navy Federal Credit Union (NFCU) account is not showing a pending deposit, there could be several reasons for this:

1. Processing Time

The deposit may have been made after the end of the business day or on a non-business day (weekend or holiday), which can delay the appearance of the pending deposit until the next business day.

2. Technical Issues

There could be technical issues with NFCU’s online or mobile banking platforms, which may temporarily prevent you from seeing pending deposits.

3. Deposit Errors

The sender may have entered incorrect account information, or there may have been an error during the deposit transaction, causing a delay or failure in the deposit being recognized by NFCU.

4. Bank’s Funds Availability Policy

NFCU, like all financial institutions, has a funds availability policy that dictates when deposited funds will be available for use. Depending on the type of deposit, it may not show as pending immediately.

5. Early Access Feature

If you’re accustomed to seeing your direct deposit funds earlier than the actual pay date due to NFCU’s early access feature, any change in your employer’s payroll processing or NFCU’s early deposit availability may affect when you see your pending deposit.

6. Check Holds

For check deposits, there may be a hold placed on the funds as the check is being verified, which can delay the pending status.

Understand The Navy Federal’s Pending Deposit Process

If you’ve deposited a check and noticed that the pending status has disappeared from your transaction history, this generally indicates that the check has been processed. Here’s what you can expect during and after the pending period:

- Verification: The bank verifies the authenticity of the check during the pending period.

- Sufficient Funds Check: The bank ensures that the account the check is drawn on has enough funds to cover the check amount.

- Clearing Process: The bank completes any other necessary checks before releasing the funds.

- Funds Credited: Once the bank has finished these checks, the funds are credited to your account and the pending status is removed.

How To Fix Navy Federal Not Showing Pending Deposit

Navy Federal’s pending deposit can be resolved by checking the deposit details, understanding NFCU’s processing times, and ensuring there are no account issues. If all else fails, NFCU customer support is there to assist you.

1. Confirm the Deposit Details

Before you start troubleshooting, make sure the deposit is made. Check the details with the sender to confirm the date and amount of the transfer. Mistakes in the transfer details could lead to delays.

To confirm the deposit details, follow these steps:

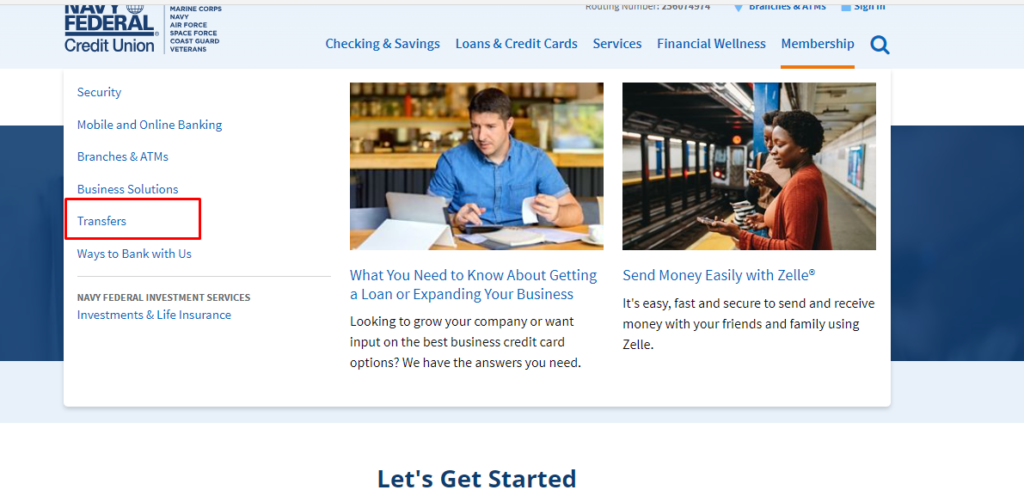

- Log in to your NFCU account online or through the mobile app and Click on the “Services” tab.

- Navigate to the “Account Summary” or “Transactions” section.

- Review your recent or pending transactions for the deposit. Details include name, account information and payment date.

2. Check for Delays

It’s important to note that while the pending status is removed and funds are credited, there might still be a clearing period before you can withdraw or use the funds.

This period allows the bank to handle any issues that might arise after the initial processing, such as a bounced check due to insufficient funds in the issuer’s account.

Some deposits take longer to process. For example, deposits made after business hours, on weekends, or on holidays may not show up until the next business day.

3. Review NFCU’s Deposit Posting Schedule

NFCU has specific times when deposits post. If you’re expecting a direct deposit, NFCU often makes these funds available one business day before the actual pay date.

For other types of deposits, the timing can vary. Check NFCU’s deposit posting schedule for guidance.

4. Verify Your Account Status

Make sure your account is in good standing. If there are any restrictions or holds on your account, it could affect the visibility of pending deposits.

These issues can include, but are not limited to:

- Potential fraud or security concerns: If there’s suspicious activity that suggests fraud or a threat to the security of your account, NFCU may restrict access to mobile deposit services.

- Unknown address: If NFCU does not have a current address on file for you, or if issues are verifying your address, this may affect your eligibility.

- Identity or membership verification problems: Accurate identification is crucial for financial services. If NFCU cannot verify your identity or membership status, access to the mobile deposit service may be denied.

5. Check for Notifications

If there’s an issue with a deposit, NFCU might have sent you a notification. Check your email, text messages, and in-app notifications for any messages regarding your deposit and fund availability.

6. Reinstall the NFCU Mobile App

If none of the above steps work, try uninstalling and then reinstalling the NFCU mobile app. This can fix issues caused by corrupt app files or incomplete updates.

To Uninstall Navy Federal App:

- For Android: Long press “Navy Federal Credit Union App” > Click on “Uninstall App“

- For iOS: Press and hold the “Navy Federal Credit Union app” icon > Tap on “Remove App” or the minus “(-)” sign.

To Install Navy Federal App:

- For Android: Go to “Play Store” >Search “Navy Federal Credit Union App” > Click on “Install”

- For iOS: Go to “App Store” >Search “Navy Federal Credit Union App” > Click on “Install“

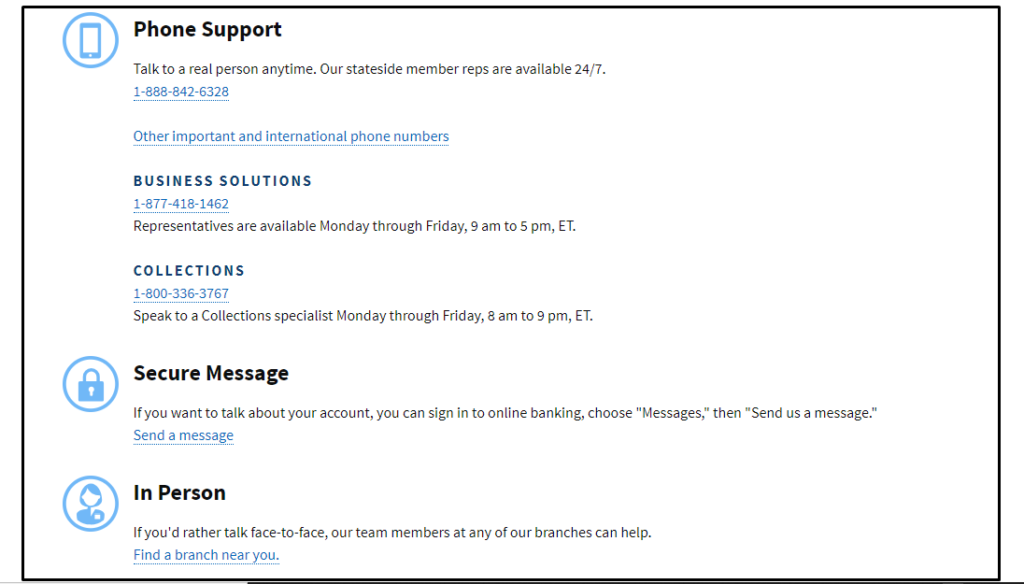

7. Contact NFCU Support

If you’ve gone through the above steps and still don’t see your pending deposit, it’s time to contact NFCU or contact the nearby branch for help. They can provide more detailed information about your account and any deposits.