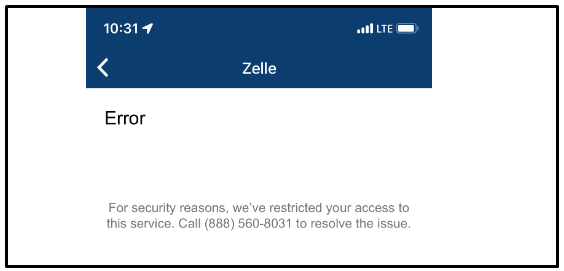

When your Navy Federal Zelle account is suspended, it can be a significant inconvenience, especially if you rely on it for quick money transfers.

Zelle usually suspends your account if it finds any suspicious or unknown transactions on your account and you cannot Zelle account anymore.

In this blog, we will guide you on how to address the “Navy Federal Zelle account suspended” issue and restore your Zelle service.

Why Navy Federal Zelle Account Gets Suspended?

A Navy Federal Zelle account may be suspended for several reasons, often related to security and compliance measures. Here are some common reasons for suspension:

1. Suspicious Activity

If there are unusual patterns of transactions that look like fraudulent activity, Zelle or Navy Federal may suspend the account to prevent potential fraud.

2. Violation of Terms and Conditions

If the user has violated Zelle’s or Navy Federal’s terms of service, the account may be suspended as a consequence.

3. Multiple Failed Login Attempts

To protect your account, multiple failed login attempts can result in a temporary suspension.

4. Unverified Information

If there are discrepancies in the account information or verification process, access to Zelle may be suspended until the information is verified.

How To Fix Navy Federal Zelle Account Suspended Issue

If the Navy Federal Zelle Account is Suspended, verify and update your Zelle information, verify your identity or if required, contact Navy Federal support.

1. Verify Your Information

If your profile is temporarily locked, it could be due to incorrect login attempts or outdated personal information.

Ensure that all your details, such as your U.S. mobile number and password, are up to date and entered correctly.

2. Update Your Zelle Information

If you’ve recently changed your email address or phone number, you’ll need to update this information with Zelle.

Your Zelle account may be suspended if your contact information is not current or if it’s still linked to another financial institution.

To update contact details in Zelle through your online banking in five steps:

- Access Payments: Log in to your online banking portal and click on the “Payments” option within the welcome banner.

- Go to Settings: Within the Zelle section, find and click on “Settings.”

- Edit Contacts: Scroll to the “Contacts” area, choose the contact you wish to modify, and click on their name to view details.

- Update Contact Information: Use the “Edit,” “Delete,” or “Add” options to change names, email addresses, phone numbers, or account numbers as needed, making sure to save each change.

- You will receive code to verify your identity while changing the email and phone number.

3. Confirm the Reason for Suspension

It is crucial to understand why your account was suspended. Common reasons include suspicious activity that could suggest fraud or a breach of Zelle’s terms and conditions.

Navy Federal does not remove restrictions that Zelle has noted as being caused by fraudulent activity, and they are not notified of what the activity was.

4. Review Navy Federal and Zelle Terms

Make sure that you’re familiar with the terms of service for both Navy Federal and Zelle. You may find specific instructions or conditions that apply to your situation in the Zelle and Other Payment Services Terms provided by Navy Federal.

Summary of the key points from the Zelle Payment Services Terms provided by Navy Federal:

- Zelle and other payment services allow you to transfer funds between accounts. When you enroll in these services, you agree to the terms of use.

- Transfers have limits based on your account status.

- Transfers to recipients are subject to the timing of their bank.

- Only send money via Zelle to trusted recipients.

- You are responsible for providing accurate information and determining if transfers are appropriate.

- Report any errors within specified timeframes to receive provisional credit.

- Navy Federal can suspend or terminate your payment services access at any time.

- You agree to indemnify Navy Federal from third-party claims related to your use of these services.

- Usage data may be collected and disclosed for service operations.

- The terms contain procedures for error resolution and limiting liability.

5. Contact Navy Federal Credit Union

Get in touch with Navy Federal’s customer support. You can contact the Navy Federal Zelle Support team at 1-888-842-6328 for instructions on how to transfer your U.S. mobile number or email address to your Navy Federal account if it’s connected to Zelle at another financial institution.

Restoring access to your Zelle account may take some time, especially if there are security concerns that need to be addressed. Be patient and follow up with Navy Federal as needed.

6. Try After a Few Months

Reddit users have reported regaining access to their suspended Zelle accounts after 9 months, suggesting that Zelle may have an undisclosed time limit after which suspended accounts are automatically restored.

How to Avoid Navy Federal Zelle Account Suspension?

To avoid having your Navy Federal Zelle account suspended, follow these best practices:

1. Secure Your Account

Use strong, unique passwords for your online banking and Zelle accounts, and change them regularly. Enable two-factor authentication if available.

2. Update Personal Information

Keep your contact details, such as phone number and email address, up to date in your Zelle profile to avoid discrepancies that could raise flags.

3. Be cautious during transactions

Regularly check your account for any unauthorized or suspicious transactions and report them immediately.

Do not do transactions( Both sending and receiving money) on an unknown account. If Zelle finds any suspicious activity on sender account, they probably suspend your account too. So make transactions only with friends and family members.

4. Avoid Multiple Zelle Enrollments

Do not link your email address or phone number with Zelle at multiple banks, as this could lead to issues with your account.

5. Educate Yourself on Fraud Prevention

Stay informed about common scams and fraud tactics to avoid falling victim to activities that could compromise your account.