Chase Bank is one of the largest financial institutions in the United States, offering a range of banking services including the ability to transfer money to another person.

While Zelle is a popular option for transferring money, it is not the only way to do so.

In this article, we will provide you with a detailed guide on how to transfer Chase money to another person without using Zelle.

Method 1: Using Wire Transfer

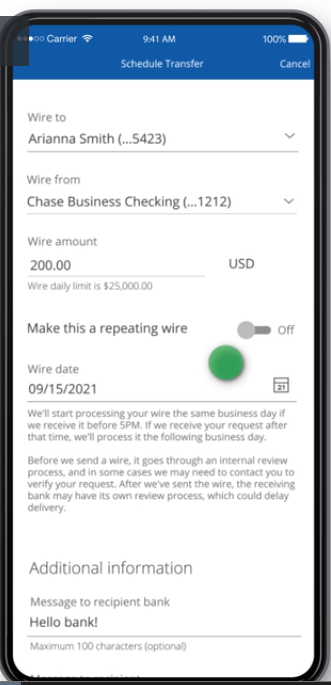

Another way to transfer money from Chase to another person is through a wire transfer. Here are the steps to complete a wire transfer:

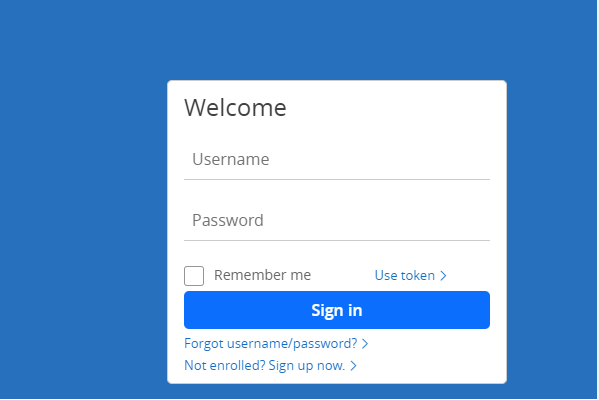

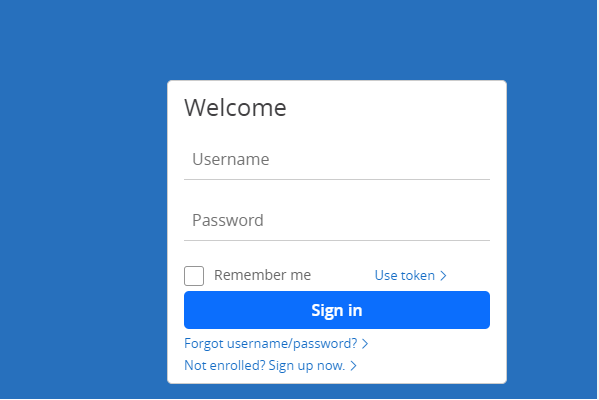

- Log in to your Chase account: Go to the Chase website and log in to your account using your username and password.

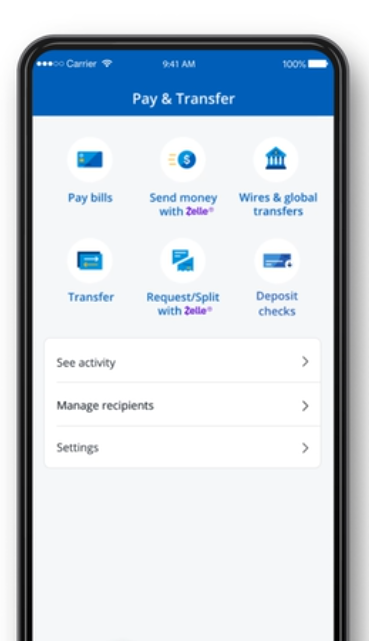

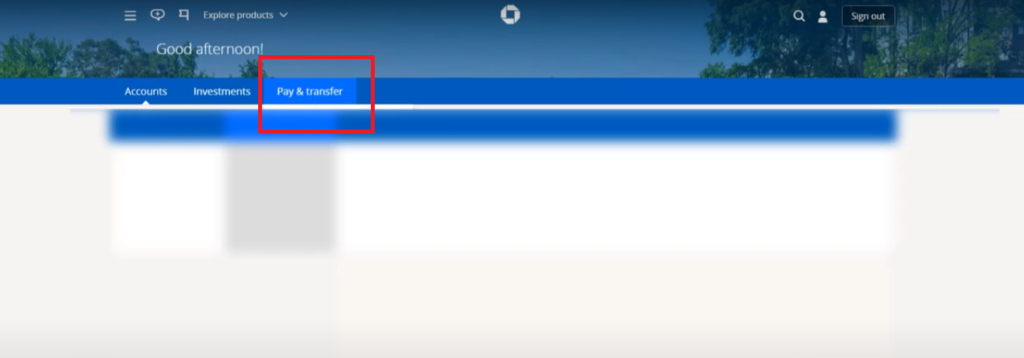

- Navigate to wire transfer: Click on the “Pay & transfer” tab and select “Wires and Global Transfers.”

- Enter recipient information: Enter the recipient’s bank account information, including the bank name, routing number, and account number.

- Confirm payment: Review the payment details and click “Send Money” to confirm the transaction.

- Notify the recipient: Once the payment is sent, notify the recipient to check their bank account to confirm receipt of the payment.

Method 2: Using Check

If you prefer a more traditional method, you can also transfer money from Chase to another person by writing a check. Here are the steps to write a check:

- Log in to your Chase account: Go to the Chase website and log in to your account using your username and password.

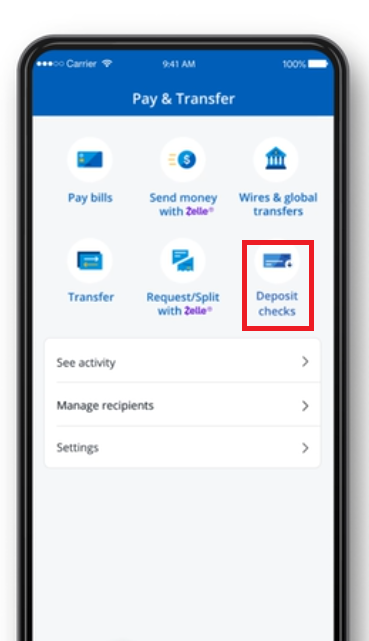

- Navigate to check writing: Click on the “Pay & transfer” tab and select “Deposit check.”

- Enter recipient information: Write the recipient’s name on the “Pay to the Order of” line and the payment amount in the box next to it.

- Sign the check: Sign the check in the designated area at the bottom right-hand corner.

- Mail the check: Mail the check to the recipient’s address or hand-deliver it to them.

Method 3: Using Chase QuickPay

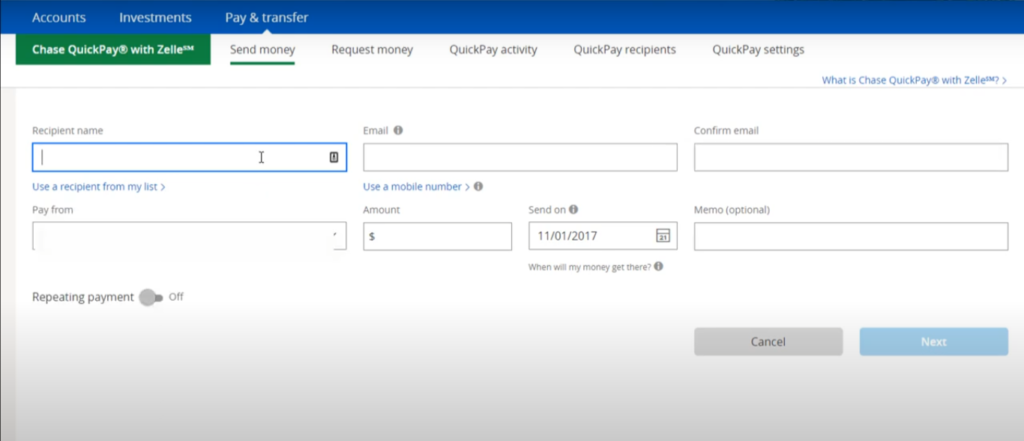

Chase QuickPay is a free service that allows Chase customers to send and receive money online. Here are the steps to transfer money using Chase QuickPay:

- Log in to your Chase account: Go to the Chase website and log in to your account using your username and password.

- Navigate to QuickPay: Click on the “Pay & transfer” tab and select “QuickPay with Zelle.”

- Enter recipient information: Enter the recipient’s email address or phone number and the amount you want to send.

- Confirm payment: Review the payment details and click “Send Money” to confirm the transaction.

- Notify the recipient: Once the payment is sent, notify the recipient to check their email or text messages to accept the payment.

Method 4: Using Cashier’s Check

A cashier’s check is a type of check that is guaranteed by the bank. It is a secure and reliable way to transfer money from Chase to other individuals or businesses.

- Visit a Chase branch: To purchase a cashier’s check, you will need to visit a Chase branch in person. Find the nearest Chase branch to you by visiting the Chase website or mobile app.

- Provide recipient information: Provide the recipient’s name and the payment amount to the Chase representative. You may also need to provide additional information, such as the recipient’s address or phone number.

- Pay the fee: The fee for a cashier’s check varies depending on the amount of the check and the bank’s policies. You will need to pay the fee in advance before the cashier’s check can be issued.

- Receive the cashier’s check: Once the fee is paid, the Chase representative will issue a cashier’s check for the payment amount. The cashier’s check will be made payable to the recipient and will include the bank’s guarantee.

- Send the cashier’s check: You can send the cashier’s check to the recipient by mail or hand-deliver it to them. Make sure that the recipient endorses the check by signing the back of it before depositing it.

Method 5: Using Automated Clearing House (ACH) Transfer

An ACH transfer is a type of electronic funds transfer that allows you to send money from your Chase account to another person’s bank account.

- Sign in to your Chase account: Go to the Chase website and log in to your account using your username and password.

- Navigate to Payment Center: Click on the “Pay & transfer” tab and select “Payment Center.”

- Choose ACH payment file upload: Click on “ACH payment file upload” and select “Create new file.”

- Add recipient information: Enter the recipient’s name, bank name, routing number, and account number in the appropriate fields. You can also add a payment description and payment amount.

- Save the file: Once you have entered all the necessary information, save the file to your computer.

- Upload the file: Return to the Payment Center and select “ACH payment file upload.” Click “Choose File” and select the file you saved in step 5.

- Verify payment details: Review the payment details to make sure they are correct.

- Confirm payment: Click “Submit File” to confirm the transaction.

- Notify the recipient: Once the payment is sent, notify the recipient to check their bank account to confirm receipt of the payment.