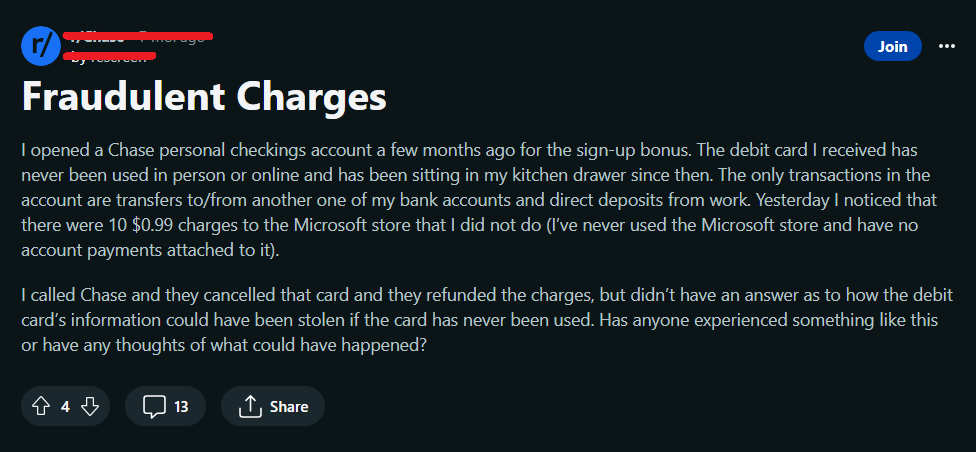

Did you go through your Chase account and notice unauthorized charges or transactions made through your account? Are you wondering what should you do after noticing fraudulent transactions through your Chase debit card?

Chase Bank, officially known as JPMorgan Chase Bank, is one of the largest and most prominent banks in the United States. It is a subsidiary of JPMorgan Chase & Co., one of the largest and most well-known financial institutions in the world.

Chase provides online banking services, allowing customers to manage their accounts, pay bills, transfer funds, and perform various financial transactions through their website and mobile app.

If you have noticed transactions that were not made by you through your debit card, it must be an extremely stressful situation.

Do not worry, however, as this article will help you understand why there may be unauthorized charges on your Chase debit card and what should be the next steps if you notice unauthorized charges.

Why Are There Unauthorized Charges On Chase Debit Card?

If you see some unauthorized charges on your Chase debit card, you may have lost your card, your card may have been skimmed or phished, or your computer or mail might have been hacked.

1. Lost Debit Cards

If you have recently lost your debit card and did not lock it by informing Chase customer service, your debit card may have been misused for unauthorized transactions by thieves, hackers, or fraudsters.

2. Debit Card Theft Or Skimming

Your debit card may have been skimmed while using the ATM to withdraw money or while making a purchase at any place through your card.

Card skimming is the stealing of credit and debit card data as well as PIN information when the user is at an ATM or about to make a payment at a store.

Card skimming enables fraudsters to steal funds from bank accounts, buy things, and sell card data to unauthorized organizations for the same goals.

3. Debit Card Phishing

If you have been phished recently through email or a phone number, you may have been tricked into providing sensitive information such as your debit card details.

Phishing is the deceptive practice of sending emails or other messages that appear to be from legitimate companies in order to trick people into disclosing personal information such as passwords and debit card data.

4. Mail Or Computer Hacked

If your computer or your email account has been hacked recently, the hacker may have obtained debit card details and made unauthorized transactions through it.

What To Do If There Are Unauthorized Charges On Chase Debit Card?

If there are unauthorized charges on your debit card, first check the details of the charge and check whether it’s a fraud. If it is a fraud, report it to the Chase customer service and lock your card immediately.

1. Check Details Of the Charge

- To go through the details of the charge or transaction, sign in to your Chase account or app.

- Look for the unauthorized charge from the list of transactions.

- Click on the arrow on the right side of the entry to view the details of the charge.

- Now you can view details such as the merchant, mode of transaction (online/offline), transaction date, address, description, etc. Note that you will not be able to view these details for a pending transaction.

2. Check Whether It Is A Fraud

After viewing the details of the charge, verify if the payment was made by you or by an unauthorized person. If the payment wasn’t made by you and you had not given your card to anyone at that point in time, report fraud to Chase customer service.

3. Report and Lock Your Card

Lock your card to ensure no more fraudulent transactions take place. Locking your card will disable you from making new purchases, however, it will not stop you from making recurring transactions.

If fraud has been committed using your credit card, contact on the number 1-800-955-9060. If the fraud has been committed using your debit card, contact the number 1-800-978-8664.

Report the fraud as quickly as possible on these helpline numbers and lock your credit or debit card.

Does Chase Refund Unauthorized Charges?

If there are unauthorized charges or transactions made on your account while you still have the debit card with you, Chase will refund you the complete amount of unauthorized charges.

If you have Chase’s Zero Liability Protection you won’t be held responsible for unauthorized charges made with your card or account information.

How Does Chase Handle Unauthorized Charges?

Chase will lock your current debit or credit card and issue you another card once they confirm the transactions and charges made through your account are unauthorized and fraudulent.

You will need to first, however, file a report after confirming the fraud. Details such as date of transaction, merchant, amount of charges, phone number, and address may be asked while filing the report.

If unauthorized charges are made through your Chase debit or credit card, you must report Chase customer service immediately to avoid further unauthorized transactions.

You will then receive a fraud affidavit at your address. Once you sign the document and submit it, a formal investigation will begin looking into the fraud. They will also refund

If you have Chase’s Zero Liability Protection, you won’t be held responsible for unauthorized charges made with your card or account information.