When you pay for your phone service with Straight Talk, you might notice some extra charges on your bill. These are taxes and fees that the government or phone company adds.

The amount you pay can change depending on where you live and how much you use your phone.

This article will talk about these extra costs from Straight Talk so you know what to expect on your bill.

Understand The Straight Talk Taxes and Fees

Navigating the landscape of telecommunication taxes and fees can be complex.

Here’s what you need to know about the additional costs that appear on your Straight Talk bill.

1. The Basics of Telecommunication Taxation

Telecommunication taxation is a multifaceted aspect of your phone bill.

Each state can levy its own tax rates on mobile services, which may include state sales tax, communication service taxes, and other statutory surcharges.

These taxes are compulsory and mandated by law, meaning you’re required to pay them as part of your service with Straight Talk.

Keep in mind that tax rates can vary greatly from one location to another.

2. Types of Taxes and Fees on Your Straight Talk Bill

When you review your Straight Talk bill, you’ll generally encounter several types of charges beyond the cost of the plan itself. These might include:

- Sales Tax: This is determined by your billing address and can differ by state and locality.

- Federal Universal Service Fund (FUSF): A fee that supports telecommunications services in underserved areas.

- State Telecommunications Excise Tax: Specific to some states, used to fund a variety of state programs.

- E911 Fee: Helps finance emergency services, and the amount may be dictated at the state or county level. This fee is crucial in ensuring your access to emergency services is maintained.

What are Federal Taxes and Fees?

As a consumer of wireless services, you are required to pay certain federal taxes and fees on top of your monthly bill.

These charges are mandated by the federal government and are the same across all states.

1. Federal Universal Service Fund

The Federal Universal Service Fund (FUSF) fee is collected from telecommunications companies to ensure that all regions of the country, including rural and high-cost areas, have access to telecommunication services.

This fee often varies each quarter and can impact your bill slightly depending on the current rate.

2. Federal Excise Tax

Your bill will also include the Federal Excise Tax, which is a tax levied by the federal government on specific goods and services, including wireless communication.

This is a set percentage and applies to all taxable services associated with your phone plan.

3. Federal Regulatory Assessment Fee

The Federal Regulatory Assessment Fee is not a tax, but a charge that carriers may collect to help cover the costs they incur for complying with federal telecom regulations.

While not mandated by the government, this fee helps carriers to cover the administrative costs of adhering to federal guidelines.

What are State and Local Taxes?

When you purchase Straight Talk wireless services, your total bill includes various state and local taxes.

These can vary significantly depending on where you live and can have a notable impact on your final costs.

1. State Sales Tax

Each state has its own sales tax that applies to goods and services, including wireless services.

For example, Illinois has one of the highest wireless taxes, while Idaho’s is significantly lower.

2. Local Utility Taxes

In addition to state taxes, you may also pay local utility taxes, which are imposed by city or county governments.

These taxes fund local infrastructure and services related to telecommunications.

3. E911 Fees

Your bill will also include E911 fees, which are charged to support emergency services such as fire and rescue.

These fees can vary but are mandated to ensure that local 911 response systems are maintained and upgraded as necessary.

What are Straight Talk Specific Fees?

When managing your Straight Talk service, you’ll come across various charges. Understanding these will ensure you’re fully informed about your billing.

1. Administrative Fees

Straight Talk may include administrative fees on your monthly bill. These fees are meant to cover costs associated with government compliance and other regulatory mandates.

An example would be the Federal Universal Service Charge, which telecom companies are required to contribute to.

2. Service Fund Fee

Separate from administrative fees, there is a Service Fund Fee. This charge is a state-specific fee applied to subscribers, typically to support state programs like E911 services.

The exact cost can vary depending on the state in which you’re receiving the service.

What are Tax Exemptions and Discounts?

When you’re a Straight Talk Wireless customer, it’s important to be aware of any potential tax exemptions and discounts that could save you money.

Your eligibility for tax exemptions largely depends on state regulations, as tax rates can vary significantly by location.

1. Available Discounts

- Holiday Deals: During promotional periods, such as tax season, you might find deals that help make your refund go further, such as discounts on new devices.

- Customer Loyalty: As a returning customer, you may be eligible for exclusive discounts and promotions, ensuring your loyalty to Straight Talk is rewarded.

2. Understanding Taxes

- State-Dependent: The amount of tax you pay on services and airtime purchases through Straight Talk depends on the state you reside in. For specific rates, it’s best to consult directly with Straight Talk’s support or look up your state’s rates.

3. Common Fees

- Sales Tax: Calculated as a percentage of your purchase price, added to most transactions.

- Regulatory Costs: These might include a Universal Service Fund charge and other government-mandated fees, which are typically non-negotiable.

How Taxes Affect Your Straight Talk Plan?

When you’re a customer of Straight Talk Wireless, understanding how taxes may influence your monthly expenses is essential.

Your bill is not just the flat rate advertised, it is subject to various taxes and regulatory fees that can vary depending on your location.

1. Sales Tax

This is based on the state and local taxes that apply to your billing address. This means if your home area is in a different city or zip code than your billing address, you could see differences in the tax amounts charged.

2. E911 Fee

Most regions apply an Enhanced 911 fee to help emergency services. This fee is often mandated by state laws and can influence the total cost of your Straight Talk service.

Note: Purchasing refill cards from certain retailers like Walmart may result in no sales taxes being charged, though this depends on your state’s taxation laws.

Here’s a simple table summarizing potential charges you may see on your Straight Talk bill:

| Charge Type | Description |

|---|---|

| State & Local Sales Tax | Depends on your billing address’s state and local sales tax rates. |

| E911 Fee | A flat fee or percentage added to fund local emergency services. |

| Federal Universal Service Charge | A charge that all telecom providers are required to contribute toward universal service efforts. |

What are the Steps to Calculate Straight Talk Taxes And Fees?

To calculate taxes and fees for Straight Talk Wireless service, you would generally follow these steps:

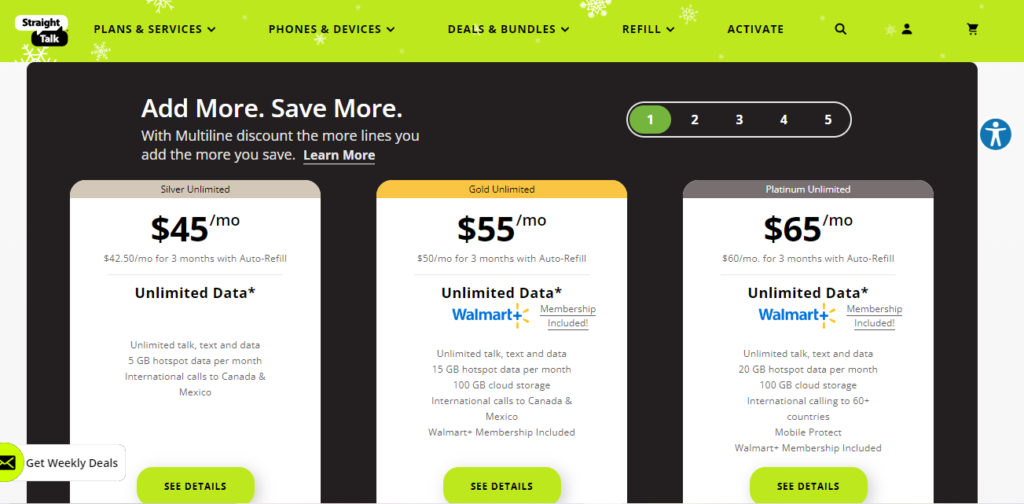

- Select a Service Plan: Visit the Straight Talk Wireless website and choose the service plan that fits your needs. Straight Talk offers a variety of plans with different amounts of data, talk, and text.

- Add to Cart: Once you’ve selected your plan, add it to your shopping cart.

- Proceed to Checkout: Click on the cart icon and proceed to checkout.

- Enter ZIP Code: During the checkout process, you will be prompted to enter your ZIP code. Taxes and fees are calculated based on the billing address associated with the ZIP code you provide.

- Review Taxes and Fees: After entering your ZIP code, the estimated taxes and fees should be calculated and displayed. This will include state and local sales taxes, as well as any applicable e911 and telecom taxes.

- Finalize Purchase: Review your order summary, which should now include the cost of the plan plus the calculated taxes and fees. If everything looks correct, you can then enter your payment information and complete the purchase.

How to Manage Taxes and Fees in Straight Talk?

Straight Talk’s prepaid plans are straightforward with fees and taxes laid out clearly, ensuring there are no surprises on your monthly bill.

Understanding your billing and knowing how to address any discrepancies can save you time and money.

1. Billing Breakdown

When you review your Straight Talk bill, you’ll notice several components. The base price of your plan is fixed, but taxes and fees can vary by location.

An itemized list on your bill should include state and local sales tax, as well as a breakdown of regulatory fees and surcharges.

As seen in a summary provided by Straight Talk Phone Plans, these fees are tacked onto the monthly prepaid plan rate, and they are comprised of charges set by regulating bodies, not by the carrier itself.

Typical charges include

- Sales tax: Calculated based on the tax rate in your area.

- Federal Universal Service Fund: A fee that supports telecommunications services in underserved areas.

- 911 service fee: A charge that helps fund emergency response services.

2. Disputing Charges

If you find an unexpected charge on your Straight Talk bill, you should first compare it against the average taxes and fees disclosed in your plan agreement.

It’s important to understand which charges are standard and which might be incorrect. If you believe there has been an error, contact Straight Talk’s customer service immediately.

Steps for dispute resolution

- Review your bill: Identify the specific charge in question.

- Gather evidence: Have documentation ready such as previous bills or plan agreements.

- Contact support: Call Straight Talk’s customer service at the provided contact number to address the charge.