Are you scratching your head because Navy Federal Credit Union denied your membership application?

There are steps you can take to potentially overturn the decision or improve your chances for future approval.

In this article, we will provide you with actionable steps and guidance on what to do if Navy Federal has denied your membership.

What to do if Navy Federal denied membership?

Understand the Reasons for Denial

Common reasons for denial can include discrepancies in personal information, such as a mismatch between your address and the one on your driver’s license.

Other reasons could include negative banking history, insufficient credit, or not meeting eligibility requirements.

Review Eligibility Requirements

NFCU has specific membership eligibility criteria. Make sure you actually qualify for membership.

You need to be affiliated with the armed forces, Department of Defense, Coast Guard, or National Guard, or have immediate family members who are.

Check Your Credit and Banking History

If your denial is due to credit or banking history, you may want to request a copy of your credit report or a ChexSystems report.

This will help you identify any negative marks that could be impacting your eligibility.

Here are the steps to check your Credit history:

- Request Your Credit Report: Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com or some other trusted authorities like this.

- Review for Accuracy: Carefully review your credit reports for any errors or inaccuracies that could negatively affect your creditworthiness.

- Address Negative Marks: If there are legitimate negative marks, take steps to address them, such as paying off debts or setting up payment plans.

Correct Any Discrepancies

If there are errors in your personal information or on your credit report, take steps to correct them.

Update your information so it matches across all documents and agencies. If there are mistakes on your credit report, file a dispute with the credit bureau.

Appeal the Decision

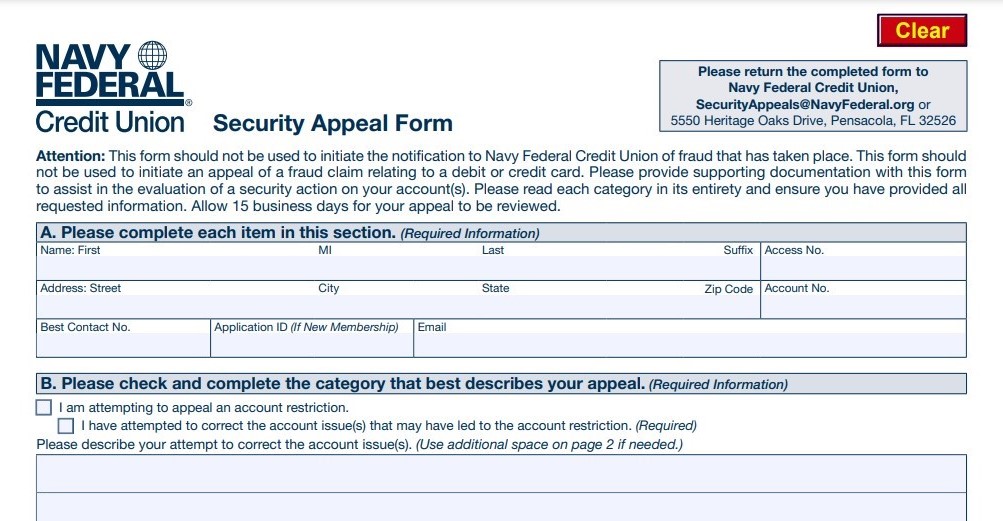

If you believe the denial was made in error, or if you have corrected any issues that led to the denial, you can attempt to appeal Navy Federal’s decision.

The Security Appeal Form provided by NFCU is the starting point for this process. Be prepared to provide necessary documentation, such as a government-issued photo ID and proof of address.

Improve Your Financial Standing

If your denial is due to financial reasons, such as insufficient income or a high balance on an existing credit card, focus on improving your financial health.

This might include paying down debts, setting up a budget, and ensuring that you have a steady income.

Consider Alternative Options

If membership with NFCU is not an option for you at this time, consider other credit unions or financial institutions that may have different membership requirements or are more suited to your financial situation.

Reapply When Ready

After addressing any issues that led to your membership denial, you can consider reapplying.

Ensure that enough time has passed for any changes you’ve made to be reflected in your records.

Remember, a denial is not the end of the road. By understanding the reasons behind it and taking corrective action, you can work towards becoming eligible for membership with Navy Federal Credit Union or find a financial institution that better fits your current situation.

Contact NFCU Directly

If you still have questions or need clarification on why your application was denied, it’s a good idea to contact NFCU directly.

FAQs

Are veterans eligible for Navy Federal membership?

Yes, veterans, retired servicemembers, and active duty members across all branches of the armed forces are eligible for Navy Federal membership.

This includes the Army, Marine Corps, Navy, Air Force, Coast Guard, National Guard, and Space Force.

Q: Can Department of Defense civilian employees join Navy Federal?

Yes, DoD civilian employees, U.S. Government employees assigned to DoD installations, DoD contractors assigned to installations, and DoD civilian retirees can become Navy Federal members.

Q: Can my family members join Navy Federal?

Immediate family members of current Navy Federal members can join, including parents, grandparents, spouses, siblings, children, adopted children, stepchildren, and grandchildren. Roommates are also eligible.

Q: How long does it take to receive a Navy Federal debit card?

If you open a checking account online or by phone, your debit card will be mailed within 1 business day. Delivery time depends on postal service. You can also open an account in a branch and receive your card immediately.

Q: What are some convenient digital banking features?

Online and mobile banking provide quick access to manage your accounts. Features include online Bill Pay, money transfers, Mobile Deposit, and more.

Q: How do I add a joint owner to my Navy Federal account?

You and the joint owner must visit a branch together to validate identity and start the enrollment process. Or you can add them later by requesting a joint owner application.