Are you confused about the excess fees in your Frontier internet bill? These fees are additional fees that are charged when you use the Frontier internet services.

These fees can include government fees as well s service fees and taxes from Frontier.

If you have decided to use Frontier Internet services from here on, then you must understand these fees and taxes completely.

In this article, we will be discussing everything about these taxes and fees in Frontier Internet so that you can easily understand your bill without any hassle.

What are Frontier Taxes and Fees?

When examining your Frontier bill, it’s important to distinguish between the various charges.

Knowing what each fee represents can help you better understand your total costs.

1. Basics of Internet Service Provider Billing

Monthly Service Charges: These are the fees for your ongoing internet service, which may include a combination of internet, home phone, and video services.

Promotional Rates: If you signed up under a promotion, your monthly rate might be lower for a set period. Upon expiration, standard rates apply.

2. Explanation of Taxes and Fees

Taxes: Your bill will include federal, state, and local taxes. These taxes are mandated by government entities and are not set by Frontier.

Surcharges: Frontier may apply additional charges like the Internet Infrastructure Surcharge to fund maintenance and upgrades.

Equipment Fees: Costs for devices like routers or DVRs that you rent from Frontier will appear as separate line items.

Fees for Additional Services: Premium features like enhanced security or premium channels add extra charges to your bill.

Detail Breakdown of Frontier Charges

When managing your internet expenses with Frontier, being aware of the various types of charges on your bill is essential.

This section will clarify each category of fees you may encounter.

1. Monthly Service Charges

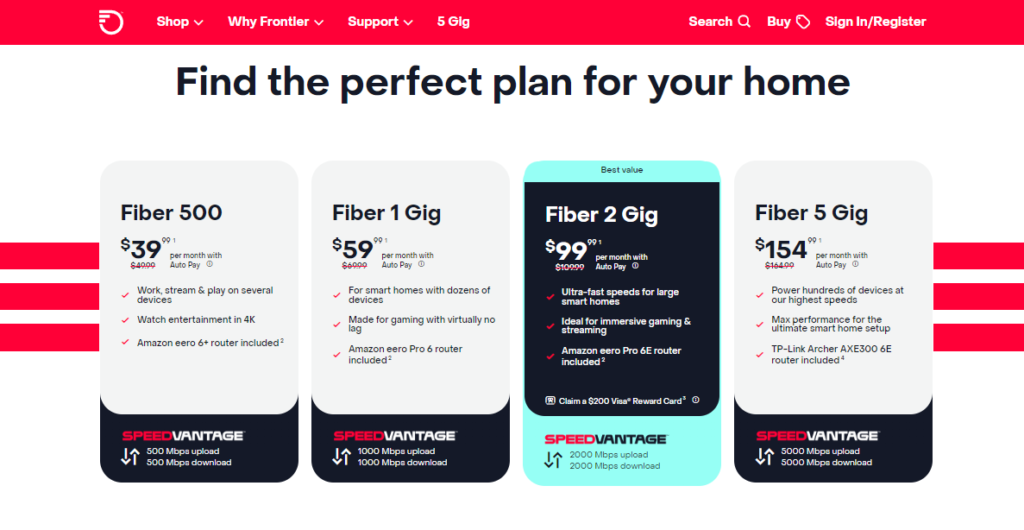

Your Frontier bill will primarily consist of Monthly Service Charges, which are the base costs for your internet package.

Plan rates can start at around $50 for 500 Mbps of fibre internet and can go higher depending on the speed and services you choose.

Each plan has its specific rate which remains consistent every month, barring any promotions or changes to your service.

2. One-Time Fees

One-time fees may include charges for installation or equipment setup. These are costs that, as the name suggests, you pay only once when you initiate or modify your Frontier services.

For example, there might be a standard installation fee or an activation fee for new equipment or services.

3. Government and Regulatory Fees

This category includes fees mandated by government entities. It encompasses charges like the Federal Universal Service Fund fee, which supports telecommunications services in underserved areas, and regulatory recovery fees that recover the cost of state and federal regulatory fees imposed on telecommunications providers.

You might see a City Tax or a charge for the Emergency Service Fee for 911 on your Frontier bill, which are typical government-related costs.

4. Other Possible Fees

Lastly, there are Other Possible Fees, some of which are specific surcharges or taxes that change based on local regulations and Frontier’s policies.

These can vary greatly and might include an Internet Infrastructure Surcharge or a Gross Revenue Surcharge.

These are not government-mandated but are assessed by Frontier based on the costs of maintaining and improving their infrastructure and services.

How to Calculate Taxes and Fees in Frontier?

Calculating taxes and fees on your Frontier bill requires careful attention to detail since they can vary based on local taxes and federal charges. Here’s how you can calculate them:

1. Review Your Frontier Bill

Begin by looking at the base price of your Frontier service before taxes and fees. This is the monthly cost for the service you are subscribed to.

2. Identify Fixed Fees

Frontier may charge fixed fees in addition to your service cost. These can include regulatory recovery fees, equipment rental fees, or other service-related fees.

3. Understand the Taxes

Taxes are determined by federal, state, and local laws and can include sales tax, telecommunications relay service tax, and other government-imposed charges.

4. Find the Tax Rates

The specific tax rates are based on your location and can often be found on your billing statement or by contacting Frontier directly.

5. Calculate Fixed Fees

Add any fixed fees to the base price of your service. These fees are typically the same amount each month.

6. Determine Variable Taxes and Fees

Apply the tax rates for your area to the total of your base service cost plus any fixed fees to calculate the variable taxes and fees.

7. Add Up Total Taxes and Fees

Combine the fixed fees with the calculated taxes to get the total amount of taxes and fees.

8. Review Your Billing Statement

Frontier provides a detailed billing statement that itemizes the taxes and fees. Use this statement to check your calculations and understand the charges on your bill.

9. Contact Frontier for Assistance

If you’re unsure about any of the charges or if you need help understanding your bill, contact Frontier’s customer service at 844-350-1065 for a detailed breakdown and explanation.

How to Lessen Taxes and Fees in Frontier?

Managing your Frontier internet bill effectively can lead to cost savings, specifically by reducing taxes and fees.

Learn about bundling your services or taking advantage of limited-time promotions to achieve this.

1. Bundling Services Discounts

By bundling services with Frontier, such as combining your internet with home phone or television packages, you may be eligible for discounts.

Bundles often provide reduced prices compared to purchasing services separately, which can also lead to lower associated taxes and fees on your monthly bill.

2. Limited-Time Promotions

Keep an eye out for limited-time promotions from Frontier. These promotions can offer significant savings on your service plan and, consequently, reduce the taxes and fees applied.

It’s crucial to read the terms and understand the duration of the promotional period to maximize these temporary offers.

Tax Exemptions and Waivers in Frontier Internet Service

When handling taxes and surcharges on your Frontier Internet service, you may be eligible for exemptions. Understanding the criteria and application process can lead to significant savings on your bill.

1. Criteria for Tax Exempt Status

To qualify for tax-exempt status on your Frontier services, you need to meet certain state and federal guidelines.

These criteria often include:

- Non-profit status: Your organization typically needs to be recognized as a non-profit under the 501(c)(3) federal tax exemption.

- Government entities: State and local governments may be exempt from certain taxes.

- Educational institutions: Schools and libraries often qualify for tax exemptions.

- Tribal lands: Services provided on tribal lands might have different tax exemption rules.

2. How to Apply for Tax Exemptions?

To apply for tax exemptions, follow these steps:

- Gather documentation: Collect all necessary certificates and documents that verify your tax-exempt status.

- Contact Frontier: Reach out to Frontier’s customer support to inquire about the process for submitting your tax exemption documents.

- Submit your application: Provide copies of all relevant certificates and documents with your dispute to establish that your service is within the exemption criteria.

Remember that to maintain your exempt status, you may need to submit these documents periodically or whenever there is a change in your tax status. Keep records of all submissions for your files.

Some Frequently Asked Questions

1. How can I understand the taxes and surcharges on my Frontier bill?

Many taxes and surcharges are mandated by local, state, and federal laws and can vary by location. You can find detailed explanations on your Frontier bill and Frontier’s website.

2. What changes have been made to Frontier’s billing methods?

Frontier periodically updates its billing presentation, but rest assured, if you’re enrolled in Auto Pay, this service will continue without interruption.

3. Is there a fee for receiving a printed bill?

Yes, Frontier applies a Printed Bill Fee to cover the costs associated with paper billing. To avoid this fee, you can sign up for Paperless Billing which is a free service offered by Frontier.

steps to sign up for Paperless Billing through Frontier:

- Log into your Frontier account online. You can access your account by going to frontier.com and clicking “Log In” at the top of the page.

- Once logged in, go to the “Billing” section of your account. You may need to select “My Account” first and then click on a link for billing or payments.

- Look for the option to enroll in Paperless Billing. It will usually say something like “Go Paperless” or “Sign Up for Paperless Billing.”

- Click on this link/option and you will see instructions and a toggle or checkbox to opt-in to Paperless Billing.

- Select the checkbox or toggle the switch to confirm you want to sign up for Paperless Billing.

- You may need to enter your email address where bills should be sent electronically.

- Click “Submit” or “Save” to complete enrollment. You will receive a confirmation that you are now signed up for Paperless Billing.

4. How can I sign up for Paperless Billing?

It’s simple to sign up for Paperless Billing. Doing so not only eliminates the Printed Bill Fee, but it also helps the environment.

steps to sign up for Frontier Paperless Billing:

- Log into your Frontier account at frontier.com

- Select “Billing”

- Choose “Go Paperless” or “Paperless Billing”

- Toggle on Paperless Billing and enter your email

- Click “Submit” to complete enrollment

5. Why is my bill different this month?

Your bill may vary due to several factors including changes in service, promotional rate expirations, or adjustments in taxes and fees. You can get support and detailed explanations by visiting the Help Center.