“Have you recently deposited money into your Truist account but noticed the funds are not appearing in your available balance?

It’s a frustrating situation to be in when a deposit you made is not showing up where it should.

In this post, we will walk through the steps you need to take to resolve a Truist deposit that is not showing in your account.

Let’s get started with the steps you should take so you can have your Truist deposit showing up without delay.

How To Fix Truist Deposit Not Showing?

To fix the issue of the Truist deposit not showing, you should allow processing time, verify deposit details, and check transaction history. Moreover, you may also contact Truist Customer Support and submit a written dispute.

Below is a detailed explanation of all the above fixes:

1. Allow Processing Time

It’s standard for deposits to take 5-7 business days to process before they are available in your account balance.

Consider giving it this amount of time before escalating your dispute if the deposit was made recently.

Things like holds, returned items, or transfers between accounts can sometimes cause legitimate short-term delays.

Allowing the full processing timeframe to pass can prevent unnecessary follow-up if the deposit truly was just taking the expected amount of time.

2. Verify Deposit Details

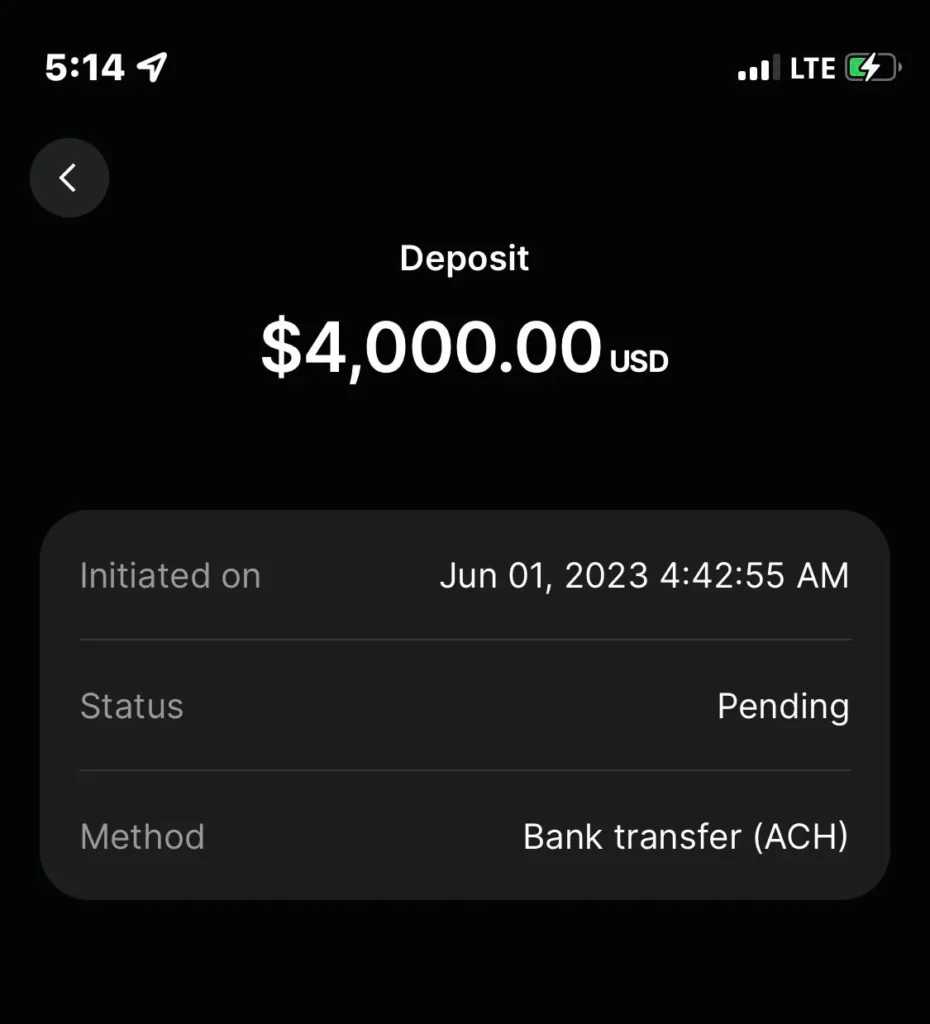

Check your physical receipt, deposit slip, or mobile banking screenshot. Validate the exact deposit amount, date, and account number. Compare to your records.

Verifying details upfront is an important step in identifying potential problems.

3. Check Transaction History

Log into online banking and carefully review account statements and transactions for 1 week before and after the deposit date.

Look at pending/failed transactions for discrepancies. Expand the date range if needed.

4. Contact Truist Customer Support

Call Truist’s dedicated number during business hours or contact them directly.

Provide your full name, address, phone number, account details, and a detailed summary of the issue including the amount deposited and date.

The representative will ask follow-up questions – be prepared to provide any other relevant details.

5. Submit Written Dispute

Use Truist’s online dispute form or mobile app to formally submit your dispute in writing.

Include copies of your deposit receipt, slip, or mobile banking screenshot for reference. This triggers their review and investigation process.