Are you having trouble with your Navy Federal check deposit not showing up in your account?

It can be frustrating when you deposit a check and it doesn’t appear in your account balance.

There are several reasons why this might happen, but the good news is that there are steps you can take to fix the issue.

In this article, we’ll explore some of the common reasons why Navy Federal check deposits might not show up, and provide you with some tips on how to fix the problem.

How To Fix Navy Federal Check Deposit Not Showing?

To fix the issue of the Navy Federal check deposit not showing, you should wait for a few days, check for holds, and verify the deposits. Moreover, you may also check with the sender and contact the support team of Navy Federal.

1. Wait For A Few Days

Sometimes, it can take a few days for a check to clear and show up in your account. To fix this, simply wait for a few days and check your account balance again later.

You can check Navy Federal’s Funds Availability Schedule to see when your deposit should be available.

To check the Navy Federal’s Funds Availability Schedule, follow these steps:

- Go to the Navy Federal Credit Union website at https://www.navyfederal.org/

- Click on the “Membership & Benefits” tab at the top of the page.

- From the drop-down menu, select “Checking & Savings.”

- Scroll down to the “Funds Availability” section and click on the “View Funds Availability Schedule” link.

- You will be taken to the Funds Availability Schedule page, which outlines how long it takes for different types of deposits to become available in your account.

2. Check For Holds

Navy Federal may place a hold on your deposit for a variety of reasons, such as if the check is for a large amount or if it’s from a new account.

To fix this, check your account to see if there’s a hold on your deposit.

To check if there is a hold on your deposit in your Navy Federal account, follow these steps:

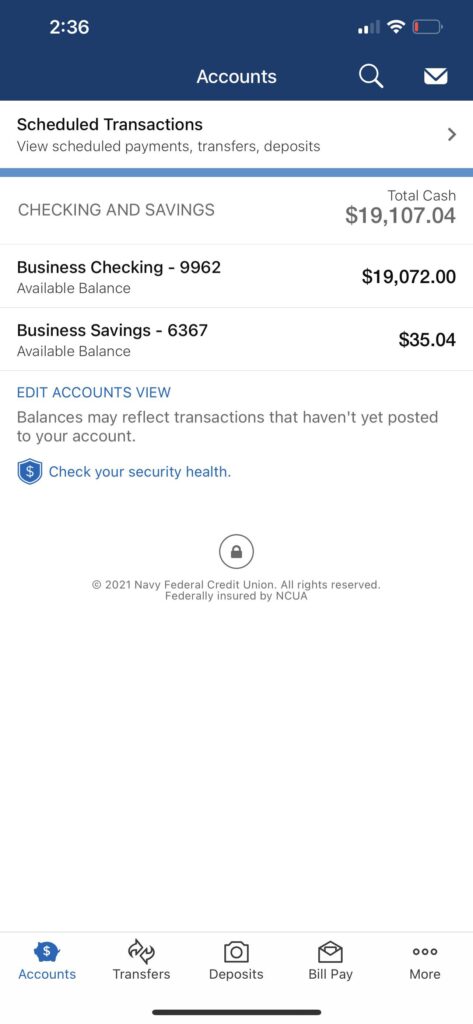

- Log in to your Navy Federal account online or through the mobile app.

- Once you’re logged in, navigate to your account summary page.

- Look for your most recent deposit in the transaction history and click on it to view the details.

- Check the “Available Balance” and “Current Balance” fields to see if there’s a difference between the two amounts.

- If there is a difference between the two amounts, there’s likely a hold on your deposit. In this case, simply wait until the hold is released and check your account balance again later.

3. Verify The Deposit

Make sure that you deposited the check correctly. If you used a mobile deposit, double-check that you took clear photos of both sides of the check and that you entered the correct deposit amount.

If you deposited the check at an ATM, make sure that you followed the instructions correctly.

4. Check With The Sender

If you are receiving checks on a monthly basis and they are all subject to a 5 business day processing time, it may be worth checking with the sender to see if there’s anything they can do to expedite the process.

For example, they may be able to switch to a different type of payment method that is processed more quickly.

To fix this, contact the sender and ask if there’s anything they can do to speed up the processing time for your checks.

If they are unable to do so, you may need to adjust your own budgeting and financial planning to account for the longer processing time.

5. Contact Navy Federal Team

If you have been depositing checks regularly and they have been available for a day, but suddenly they are not available in a timely manner, it may be worth contacting Navy Federal to inquire about the issue.

There may be an issue with the algorithm that is causing your checks to be subject to longer processing times.

To fix this, contact Navy Federal and ask if there is any issue with your account or with the algorithm that is causing your checks to be subject to longer processing times.

They may be able to provide you with more information and help you resolve the issue. You may contact them by clicking on the link here.