StubHub is a ticket exchange and resale company that connects ticket buyers and sellers.

It is a full-service online marketplace for buyers and sellers wishing to purchase or sell tickets for sporting events, concerts, plays, and other live entertainment.

If you have purchased tickets from StubHub, you may have noticed that the cost appears to include extra fees. But you might be confused about how these fees are determined.

This post will go over StubHub’s taxes and fees in detail so that you have a pleasant experience when purchasing tickets from them.

What is StubHub’s Fee Structure?

When purchasing or selling tickets on StubHub, you are subject to specific fees which vary by transaction type and event.

1. Breakdown of StubHub’s Seller Fees

As a seller on StubHub, you are charged a fee upon the successful sale of your tickets. This fee is a percentage of the ticket price, which can fluctuate based on factors like event type, ticket demand, and proximity to the event date.

While there isn’t a set fee percentage, seller fees have been known to range, potentially affecting your total earnings from the sale.

2. Explanation of StubHub’s Buyer Fees

Your experience as a buyer includes dealing with specific fees added to the purchase price of your tickets. These fees are not fixed and can change, with StubHub adjusting them according to factors such as event popularity and ticket availability.

Buyer fees may include service charges and fulfilment costs, but unlike a static pricing model, they can vary greatly, impacting the final amount you pay.

What are Tax Implications for StubHub Transactions?

When dealing with StubHub transactions, it’s essential to understand the tax responsibilities involved.

For sellers, this includes reporting income and understanding new IRS regulations. Buyers need to be aware of sales tax that may be added to their ticket purchase.

1. Tax Responsibilities for Sellers

As a seller on StubHub, you are obligated to report your income from ticket sales to the IRS. Following updates effective from January 1, 2023, if your gross sales exceed $600 within a calendar year, you are subject to form 1099-K documentation.

- Personal Tax Identification is necessary for StubHub to generate your 1099-K.

- Recording Sales: Keep track of your ticket sales for accurate reporting.

2. Applicable Taxes for Buyers

When you purchase tickets on StubHub, sales tax may be applied based on the event location. StubHub automatically calculates and collects this tax, which does not affect your income taxes as a buyer.

- Sales Tax Rate: This can vary by state and is added to your purchase amount.

- No Reporting Required: This tax collection is managed by StubHub and does not require additional action on your part.

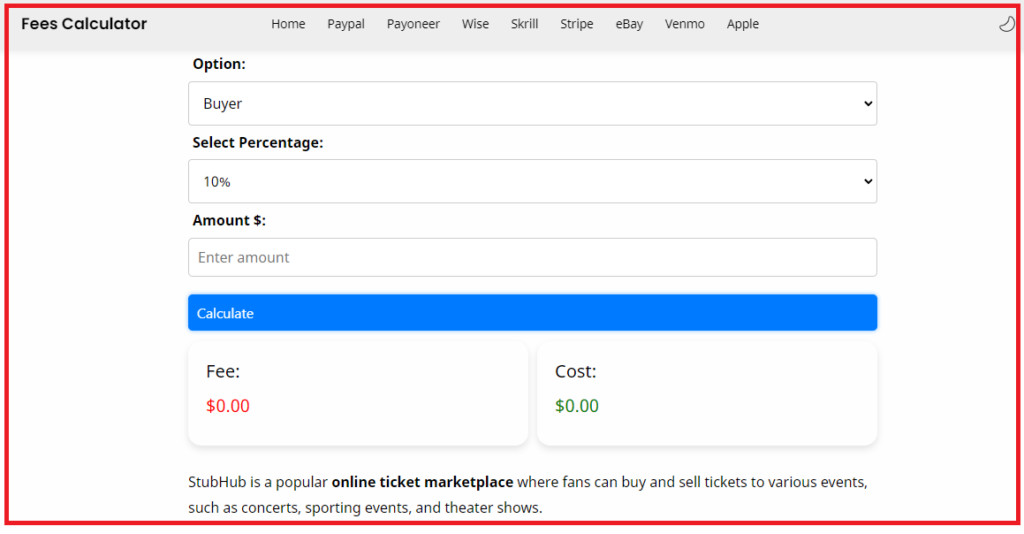

How to Use Calculator to Calculate StubHub Taxes and Fees?

To use a StubHub fees calculator to determine the taxes and fees for selling tickets on StubHub, you would generally follow these steps:

1. Access the Calculator

Find a StubHub fees calculator online. There are third-party tools available, such as the one mentioned in the search results, which can be found at Fee Calculator Info.

2. Enter Ticket Details

Input the details of the ticket you are selling, including the selling price. This is the price you would like to list your ticket for on StubHub.

3. Calculate Fees

The calculator will automatically compute the StubHub selling fees based on the selling price you’ve entered. It will take into account the service fee and any other additional charges that may apply.

4. View Results

Review the breakdown of the fees to understand how much you will pay in fees and how much you will receive from the sale after the fees are deducted.

5. Adjust Price if Necessary

If the net amount you will receive after fees is not satisfactory, you can adjust the selling price accordingly and recalculate the fees until you find a balance that works for you.

How to Manage Fees and Taxes on StubHub?

Effective management of fees and taxes on StubHub can save you money and ensure compliance with tax regulations.

Tips for Minimizing Fees

- Compare Listing Prices: Before listing tickets on StubHub, compare your intended price to current listings to ensure competitiveness without undervaluing.

- Bulk Uploads: Use StubHub’s bulk upload feature for multiple listings to save time and potentially reduce mistakes that could cost fees.

Strategies for Tax Management

- Track Sales Carefully: Keep detailed records of all your sales, as StubHub will report gross payments exceeding $600 to the IRS Overview of 2023 1099-K Regula tions.

- Deductible Expenses: Remember that StubHub’s seller fees are not taxable, and you should deduct them from your gross sales when reporting income.

StubHub vs. Competitors

StubHub has established itself as a major player in the ticket reselling market by offering a platform where fees vary. While competitors might offer lower fees, StubHub justifies its pricing by citing the creation of a secure, global market.

For example, their service fees can range from 24% to 29% of the ticket cost. This contrasts with some competitors who adopt a flat fee or a consistent percentage across all transactions.

In comparison, other ticket platforms may opt for an “all-in” pricing model, which was once used by StubHub itself. This structure encapsulates all fees into the listed ticket price, promoting transparency for the buyer from the onset.

Marketplace Pricing Trends

The ticket reselling market is known for its dynamic pricing practices. “Drip pricing” has been a common trend, a method where customers only see additional fees at the final stage of confirming their purchase, which can lead to spending 21% more than anticipated.

Conversely, StubHub’s pricing strategy does not consistently adhere to a set percentage, implying that the fees you encounter may vary notably based on the event and ticket selection.