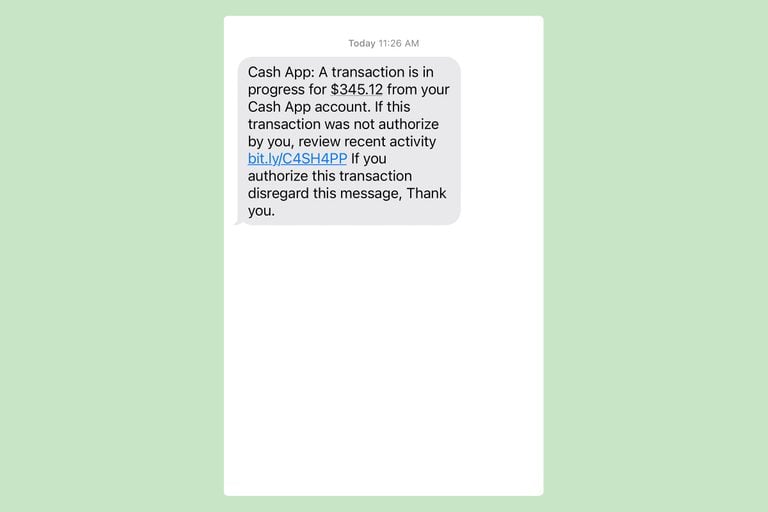

Mobile payment applications like Cash App have become popular in today’s digital era due to their practicality and simplicity. However, with the rise in digital transactions, fraudulent activities have also increased.

Suppose you discover that someone has used your debit card on Cash App without your authorization. In that case, taking immediate action to protect yourself and mitigate any potential financial losses is crucial.

This article will guide you through the steps you should follow in such a situation.

If someone has used your debit card on Cash App without your authorization, immediately secure your Cash App account by changing your password and enabling two-factor authentication. Then, contact Cash App support to report the fraudulent activity and initiate a dispute for the unauthorized transactions. Additionally, notify your bank about the situation to take any necessary protective measures.

Below are the detailed steps to follow in case someone has used your Debit Card unauthorised on Cash App:

1. Act Promptly

As soon as you notice any unauthorized activity on your Cash App account, it is essential to act quickly. Timely action can help minimize the damage caused by the fraudulent use of your debit card.

Open the Cash App on your mobile device or visit the Cash App website on your computer to access your account.

2. Secure Your Account

The first step is to secure your Cash App account.To prevent additional unwanted access, change your password right away. Create a strong password distinct from others by combining capital, lowercase, digits, and special characters.

Enable two-factor authentication as an additional security measure. This way, even if someone has your login credentials, they won’t be able to access your account without the verification code.

To enable two-factor authentication on Cash App, follow these steps:

- Open the Cash App on your mobile device.

- Tap on your profile icon in the upper-left corner.

- Scroll down and select “Privacy & Security.”

- Under the Security section, toggle on the “Two-Factor Authentication” option.

- Choose whether you want to receive the authentication code via SMS or an authentication app.

- Follow the prompts to complete the setup process.

- Once enabled, you must enter the verification code every time you log in to your Cash App account for added security.

3. Contact Cash App Support

Reach out to Cash App customer support to report the fraudulent activity as soon as possible. You can contact them via the app’s support feature. To get the support team:

- Contact Cash App support and open the app.

- Tap on your profile icon, scroll down, and select “Cash Support.”

- Then choose the issue you need help with and follow the prompts to contact their customer support team.

Explain the situation and provide relevant information, such as the specific transactions, dates, and amounts involved. Cash App’s customer support team will guide you through the necessary steps to resolve the issue.

4. Dispute Unauthorized Transactions

Cash App provides a dispute resolution process for unauthorized transactions. Initiate a dispute by contacting Cash App support and providing them with all relevant details and evidence of the fraudulent transactions.

To dispute unauthorized transactions on Cash App, follow these steps:

- Open the Cash App and go to the profile icon.

- Scroll down and select “Cash Support.”

- Choose “Something Else” as the issue.

- Select “Unauthorized Transaction” and follow the prompts to provide details about the transaction.

- Provide supporting documentation and communicate with Cash App support to resolve the dispute.

5. Report the Fraudulent Activity to Your Bank

In addition to contacting Cash App support, notify your bank about the unauthorized use of your debit card on Cash App.

Inform them about the situation and provide details about the transactions. Your bank will guide you on the necessary steps to protect your account and may initiate an investigation.