Are you trying to figure out how to send or transfer money from your Chime account to your Cash App?

Whether you’re splitting a bill with friends or paying for a recent purchase, transferring funds between these two popular financial platforms.

In this article, we’ll provide you with easy-to-follow steps to help you successfully transfer your funds from Chime to Cash App.

How to Send/ Transfer Money From Chime to Cash App?

Step 1: Open Cash App

Begin by launching the Cash App on your mobile device. Make sure you have the latest version of the app to avoid any technical issues.

Step 2: Go to Profile

Once the app is open, locate and click on your profile icon, which is typically in the top right-hand corner of the Cash App home screen.

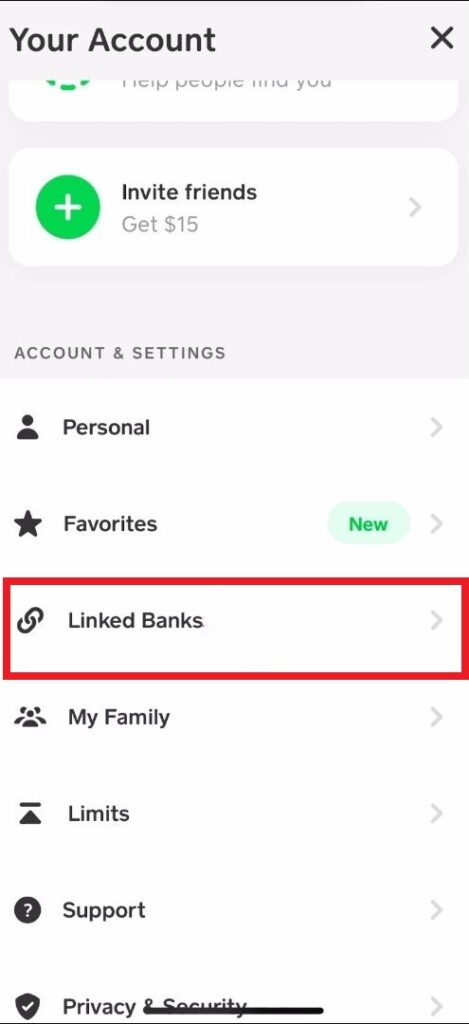

Step 3: Link Accounts

In your profile menu, here, you’ll see an option to “Link Banks.” Tap on this and then choose “Link Debit Card” to proceed with linking your Chime account.

Step 4: Select the No Card Option

After selecting “Link Debit Card,” you might be prompted to enter your card details. Since you want to link your Chime bank account instead, look for and select the “No Card?” option. Wait for the next page to load, which will allow you to continue without a card.

Step 5: Find Chime

In the provided search bar, type “Chime” and select it from the list of available banks.

Step 6: Enter Chime Credentials

You will be prompted to enter your Chime credentials. Input your Chime email address and password. This information is required to securely link your Chime account to Cash App.

Step 7: Cash Out

With your Chime account now linked to Cash App, navigate back to the Cash App home screen. Look for the “Cash Out” option, which allows you to transfer funds from your Cash App balance to your linked bank account.

Step 8: Choose Amount

Decide on the amount of money you want to transfer to Chime. Enter this amount when you tap on the “Cash Out” button.

Step 9: Select Transfer Type

After entering the amount, you’ll need to choose the transfer speed. Tap “Cash Out,” and you’ll be presented with two options:

- Standard Transfer: Selecting this option will transfer the funds to your Chime account within 1 to 3 business days. There is no fee for standard transfers, making it a cost-effective option if you’re not in a rush to receive the funds.

- Instant Transfer: If you need the money more quickly, choose the “Instant” option. This will transfer the funds to your Chime account almost immediately. However, be aware that there is a fee associated with instant transfers. The fee amount will be displayed on the screen before you confirm the transaction.

Step 10: Complete the Transfer

After selecting your preferred transfer type, follow the on-screen prompts to confirm and complete the transfer.

If you chose the standard option, check your Chime account after 1 to 3 business days to see the transferred funds. For instant transfers, the funds should appear in your Chime account shortly after you complete the process.