Are you looking for an easy way to send money from your Bank of America account to friends or family who use Cash App?

Transferring funds between your bank and Cash App couldn’t be simpler.

In this article, we’ll show you the quick and secure steps to link your Bank of America to Cash App.

How to Transfer Money From Bank of America to Cash App?

Step 1: Link Your Bank of America Account to Cash App

To initiate the process, you need to link your Bank of America account to your Cash App:

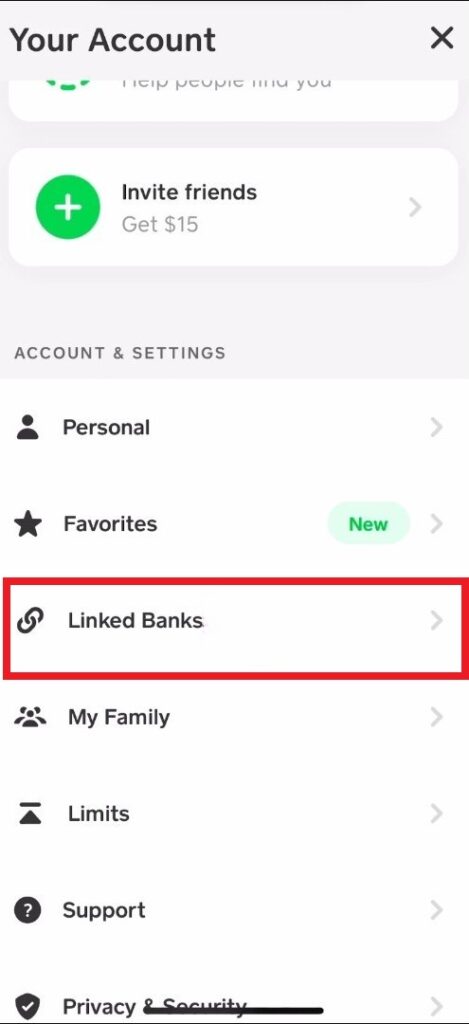

- Open the Cash App on your mobile device.

- Tap the Profile Icon in the upper-left corner of the home screen.

- Scroll down and select “Linked Banks“.

- Choose “Link Bank” and follow the on-screen instructions to enter your Bank of America account information, including your account number and routing number.

Step 2: Add Cash to Your Cash App Balance

Once your bank account is linked, you can add money to your Cash App:

- From the Cash App home screen, tap the “Banking” tab, which is represented by an icon that looks like a bank or a house.

- Press “Add Cash.”

- Use the keypad to enter the amount of money you wish to transfer from Bank of America to Cash App.

- Tap “Add” to confirm the amount you entered.

- You will be prompted to confirm the transfer by entering your PIN or using Touch ID, depending on your device’s security settings.

Step 3: Verify the Transfer

After completing the transfer, it’s important to ensure that the transaction was successful:

- The new balance should now be visible in the “Banking” tab under “Cash Balance.”

- You may also receive a confirmation notification from Cash App.

- For added assurance, log in to your Bank of America account to confirm that the funds have been debited.

Additional Tips for Transferring Money From Bank of America to Cash App

1. Secure Connection

Always make sure you are using a secure internet connection when transferring money to protect your personal and financial information from unauthorized access.

Public Wi-Fi networks are generally not recommended for financial transactions.

2. Double-Check Details

Before confirming the transfer, double-check the amount you’re transferring and the account details.

Once a transaction is processed, it can be difficult to reverse, and entering incorrect information could lead to funds being sent to the wrong recipient.

3. Keep App Updated

Ensure that your Cash App is up to date with the latest version to avoid any technical issues during the transfer process.

Regular updates often include security enhancements and new features.

4. Transfer During Business Hours

While Cash App transfers can occur any time, initiating transfers during business hours can sometimes help with quicker resolutions if any issues arise, as customer service teams are more likely to be available.

5. Contact Cash App Support When Needed

If you encounter any issues or the money doesn’t appear in your Cash App, don’t hesitate to contact Cash App support for assistance.

They can provide detailed information and guide you through any necessary steps to resolve your issue.

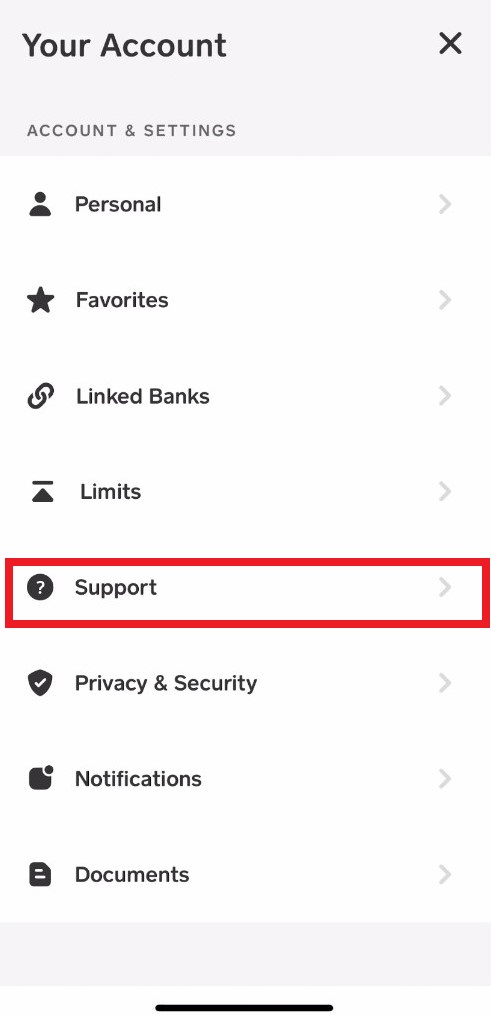

To contact Cash app support follow these steps:

- Tap the profile icon in the Cash App.

- Select Support.

- Select Start a Chat and send a message.