When you pay for your phone service with Google Fi, you might notice some extra charges on your bill. These are taxes and fees that the government or phone company adds.

The amount you pay can change depending on where you live and how much you use your phone.

This article will talk about these extra costs from Google Fi so you know what to expect on your bill.

It’s good to learn about these fees if you’re thinking about using Google Fi for your phone service.

What is Google Fi Tax and Fee Structure?

When considering a Google Fi plan, it’s important to understand that your monthly bill will come with taxes and regulatory fees that vary depending on your location and the specific plan you choose.

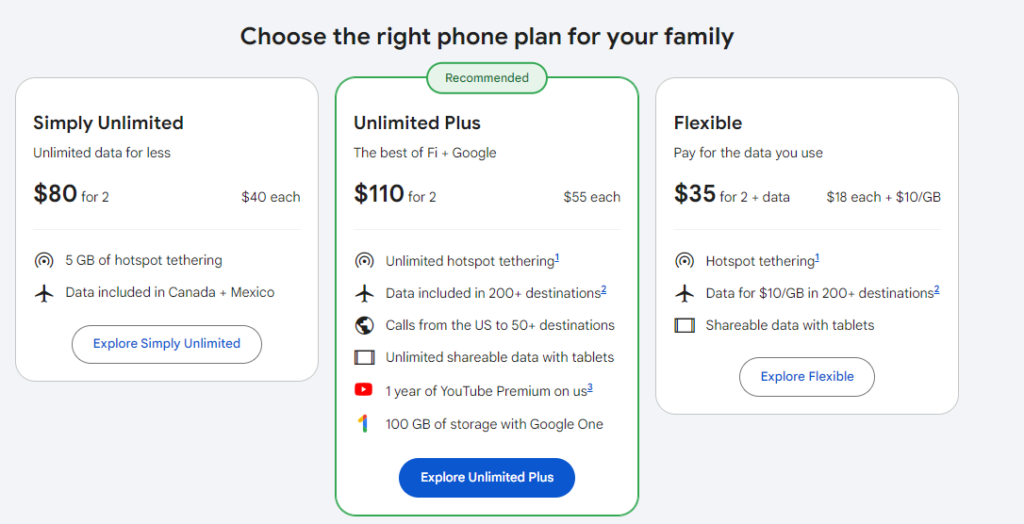

If you’re enrolled in a Google Fi Flexible plan, you prepay for your calls, texts, and data with taxes and fees applied on top of your usage.

On the other hand, the Simply Unlimited and Unlimited Plus plans include a predefined fee for unlimited usage, but taxes and fees are additional to the base cost.

Breakdown of Google Fi Tax and Fee Potential Charges:

- State Taxes and Fees: Each state imposes its tax rates and fees, which can consist of a state 911 tax and state sales tax.

- Federal Fees: Include the Federal Universal Service Fund fee, which supports telecommunications services in underprivileged areas, and the Federal Regulatory Assessment Fee to cover costs incurred from regulatory obligations.

- Other Fees: Some areas may have additional charges like a Telecommunications Relay Services Charge, which aids in providing services to individuals with hearing or speech disabilities.

To get a more precise understanding of your Google Fi bill, you can use the Google Fi app or website to access your billing information, which provides a detailed statement of your usage and charges for full transparency.

What is Google Fi Service Fees?

When you subscribe to Google Fi, your bill is not just the cost of your chosen plan.

There are additional taxes and fees that vary by region due to different local and state regulations.

Here’s a breakdown of the types of fees that may appear on your Google Fi bill:

- Sales Tax: Charged based on the tax rates of the city, county, and state, sales tax is collected by Google Fi on behalf of the respective governments.

- 911 Emergency Service Fee: This fee contributes to the costs associated with providing 911 emergency services in your area. It may be labeled differently such as “State 911 Tax” or “Local 911 Surcharge”.

- Federal and State Universal Service Fund Assessments: These are fees required to support the Universal Service Fund (USF) aimed at helping to provide phone service to all Americans, including rural and low-income individuals.

Below is an example of how these charges might appear on your statement:

| Fee Type | Description |

|---|---|

| State Sales Tax | Tax collected for the state government. |

| County/City Sales Tax | Tax collected for the local government. |

| 911 Emergency Service Fee (State/Local) | Fee for emergency services support. |

| Universal Service Fund Fees | Fees supporting universal access to phone services. |

Your total charges will therefore consist of your plan’s monthly rate plus these taxes and fees. The actual amounts can differ based on your service address and the requirements of your local and state governments.

What are the Billing and Payment for Taxes and Fees In Google Fi?

When you subscribe to Google Fi, your billing will include not only the cost for your plan but also taxes and fees that depend on your state and local regulations.

Understanding these charges is important for managing your budget and expectations.

- State and Local Taxes: These are dictated by your region and can include sales tax and state 911 taxes. For example, a user reported paying a $2.31 state 911 tax and sales tax. Each state has different tax rates that apply.

- Government Mandated Fees: These can include a Telecommunications Relay Services Charge and a Federal Universal Service Fund fee, which were $0.08 and $2.28 respectively for one user.

Remember, these fees and taxes are subject to change and may vary based on factors such as your location and changes in the law. Unlike your plan charges, these are not controlled by Google Fi but are passed through to you as required by law.

How to Use Google Fi Taxes and Fees Calculator?

Google Fi does not have a dedicated tax and fees calculator available for public use that can provide an exact amount before you sign up.

Taxes and fees can vary based on your service address and are normally between 10-20% of your bill. The exact amount is determined by local tax laws and varies by location.

However, you can get a general sense of your total Google Fi cost, including taxes and fees, by following these steps:

- Go to the Google Fi plans page.

- Select the plan that you are interested in, either Flexible or Unlimited.

- Enter your ZIP code if prompted, as this can help provide a more accurate estimate based on your location.

- Review the plan details, which should give you a base cost for the service.

- Keep in mind that the taxes and fees are not included in the displayed price and will be added to your bill.

- Once you sign up for Google Fi, your first bill will break down the different charges, including taxes and fees, so you can see exactly what you’re paying for.

For a more precise estimate of the taxes and fees, you could contact Google Fi customer service at 1-844-TALK-2-FI.

How do Google Fi Taxes and Fees Compare to Other Carriers?

When you’re evaluating Google Fi’s charges, the taxes and fees are a key part of the overall bill you’re paying each month.

For example, a user on Google Fi’s Flexible plan might notice a tax and fees charge that includes both local taxes and federal levies. Here’s a brief breakdown of what a Google Fi bill might include:

- State 911 tax

- Sales tax

- Federal Regulatory Assessment Fee

- Federal Universal Service Fund Fee

Larger carriers such as Verizon and AT&T have a similar structure where taxes and fees are concerned. But, it’s worth noting that some users report higher regulatory cost recovery fees with these carriers.

These are fees that the carrier charges to recover the cost of taxes imposed on them by the government.

In contrast, smaller, budget carriers might offer a more inclusive pricing model where the advertised rate includes all taxes and fees. For example, T-Mobile’s taxes and fees are typically included in the advertised price for their plans.