CRA (Canada Revenue Agency) is the Canadian federal government service which oversees the collection of tax and governs law and policy related to tax.

It is also responsible for the registration of charities in Canada and for providing tax credits and benefits.

CRA is headquartered in Ottawa and is one of the largest organisations based on several employees. It also enforces the tax laws in the country.

Every year a business or individual is required to file for an income tax return which decides if they owe taxes and their amount or if they will get a refund.

This has been made easy by using the online CRA service where you need to create a CRA account. You receive email notifications from CRA whenever there are important changes made to the account.

There are various services available under the MyAccount section when you create your CRA Account but to access more sensitive information you need to add a Security Code provided to you by CRA.

This article will discuss if CRA sends you a security code by email, its email notification delivery and how to identify if the mail from CRA is real.

What is CRA Security Code?

A CRA security code is a unique random eight-digit code that is temporarily linked to your CRA account. It adds a layer of protection to secure your account.

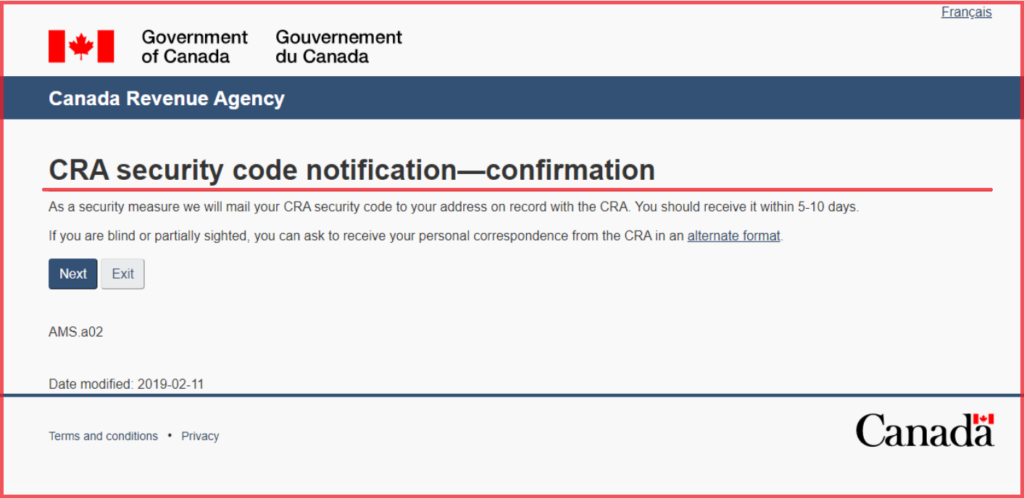

You will receive the security code after you have completed the registration process for CRA My Account at the end with an expiration date and time. You can opt to get the security code either by email or paper.

When you opt to get a security code by paper you will receive a mail within 5 to 10 days. But there is also a way to get it by email.

Does CRA Send Security Code By Email?

Yes, CRA can send a security code by email provided that you have given your email address to the CRA and have opted for it to receive an email. It is up to you to select CRA mail electronically or by paper.

You can also sign up to get email notifications if there are any emails by CRA in My Account or My Business Account.

How To Get Security Code Email Notification Delivery?

CRA will send you an email notification when your correspondence preferences are set to “Electronic mail”. You will receive an email notification whenever there is a new mail by CRA to check in My Account.

CRA mail that you can receive via email is notices of assessment, reassessment, benefits, adjustments, instalments and request to send letters for information or documentation.

To register for email notifications that you can receive from CRA, there are various ways which are mentioned below.

- Register for My Account where you will be asked to provide your email address.

- Sign in to your account through the CRA website. If you have not provided your email address then you will be prompted to enter it.

- Open the MyBenefits CRA web and there opt for “email address”.

- You can also provide your email when you file for a return with NETFILE software.

- When you send a paper tax return and benefit, there you can mention your email address.

- Mention your email address to your tax preparer who is filling out Form T183 or uses EFILE.

- You can contact Income Tax and Trust team by phone.

You can also read the Terms of Use for email notifications to understand the requirements and any changes in notification services.

After you register your email address, you will receive a confirmation email at the same address.

Does CRA Send Emails About Refunds?

No, CRA does not email you about refunds and the majority of the emails received by people are reported as phishing scams.

While the mail may look legitimate it is important to remember that CRA will never send any spontaneous emails about Tax Refund when you have not requested it.

It sends a letter by snail mail with a phone number for their representative.

The fraudulent mail portrays to be from CRA and mentions that you are eligible for a tax refund and then asks you to click on the link provided to claim your refund.

If you receive any unsolicited mail claiming to be from CRA regarding tax refund then report it and never click on the link mentioned in such email.

Also, remember to never share any personal information with them even if they insist before verifying.

How Do You Know If Email From CRA is Real?

When you receive an email notification service from CRA, always check the sender’s name which will say Canada Revenue Agency/Agence du Revenu du Canada.

The email notifications will never:

- Contain a link and asks you to click on it.

- Ask for your personal information or finance-related details.

- Request you to pay via credit cards or gift cards.

- Use an offensive tone in the email.

- Make threats or send police.

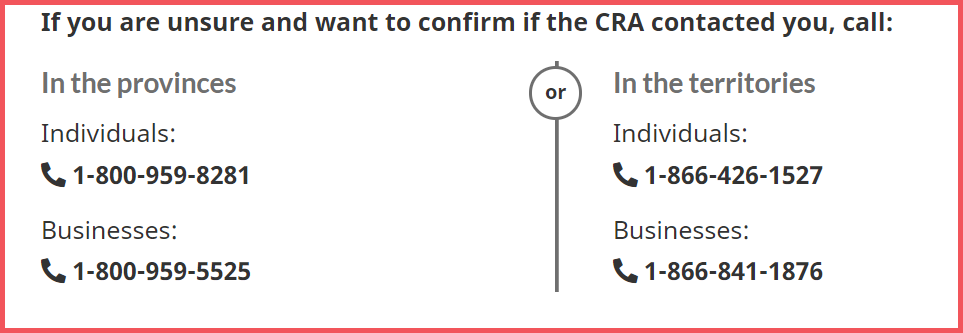

To confirm if CRA contacted you then you can verify it by call.

You can also recognize various CRA-related scams and be cautious to avoid them.

What To Do When You Are A Victim Of Scam?

If you feel that you are scammed and tricked into sharing your personal or financial information then contact the local police service immediately.

Contact CRA in any of the following instances:

- Your CRA Account is compromised.

- You find changes in your personal or banking information when you did not ask for it.

- You see your benefits application made without your consent.

- You want your online access to information disabled from CRA Sign-in services.

- You want your online access to information enabled from CRA Sign-in services after disabling it.

In addition to reporting the fraud to CRA, you should also report it to the Canadian Anti-Fraud Center.

You can also stay up to date with scam alerts that are regularly made aware by CRA.

You can also reach out to the CRA Support team by calling on 1-855-330-3305 for individual-related issues.