Does the Cash App take your money without authorization? You can fall victim to one of the many Cash App scams, which cause mobile money users to lose millions of dollars daily.

End-to-end data encryptions that are industry standard are used to safeguard Cash App payments. However, con artists are constantly working on new schemes to get you to give money to total strangers.

The worst of these scams involves hackers accessing individuals’ accounts and stealing money without their consent. Can you recover your funds after a fraudulent Cash App transaction? Instructions on reporting questionable money transfers and the Cash App’s return policy are on this page.

Can someone take money from your Cash App without permission?

No, your money from the Cash App can’t be taken without your permission. Cash App uses security measures like other financial platforms to safeguard your accounts and transactions.

However, a certain amount of danger is always present, as no system is entirely fault-proof. Despite being extremely rare, there have been cases where unauthorized people have accessed Cash App accounts and started transactions without your consent.

Why Cash App taking money without your permission

Cash App may be collecting money without authorization for several reasons. In this part, we’ll go deeper into these explanations to provide readers with a thorough grasp of the possible causes of fraudulent transactions.

1. Unlawful business dealings and security breaches

Cash App stealing money without authorization is primarily due to fraudulent transactions carried out by con artists and criminals.

To access Cash App accounts, these individuals may employ various strategies, including phishing emails, bogus websites, or social engineering approaches.

Once they access a report, they can carry out illicit activities, frequently moving money to their accounts or other people’s accounts.

2. Mistaken transactions

You could have inadvertently started a transaction, entered the wrong amount, or sent funds to the wrong person. These unintended transactions may be annoying, as they frequently stem from minor errors or misunderstandings.

Checking the recipient’s details and the transaction amount again before approving each payment is essential to reducing the possibility of unintentional transactions.

3. Subscription services and ongoing payments

You may voluntarily or unintentionally subscribe to services or agree to recurring payments. Online gaming, streaming services, and other digital goods with recurrent costs fall under this category.

You might need to pay more attention to these subscriptions or be made aware they have signed up for them, which could result in unforeseen fees and the idea that Cash App is stealing money.

You should keep track of any recurring purchases or subscription services to prevent this problem by periodically reviewing their transaction history.

4. Cash Application Fees and Service Fees

Cash App charges a fee for some transactions, like credit card payments and fast transfers to your bank account. Even though these costs are typically explicit and stated up front, some of you may need to be more informed about them or forget about them, which might confuse them when they observe the fees in their record of transactions.

You should acquaint themselves with the app’s charge structure and be aware of related expenses before conducting transactions to eliminate misunderstandings regarding Cash App fees.

Doing so makes it possible to avoid misunderstandings and ensure you are informed of potential costs.

5. System malfunctions and technical issues

Even though they are uncommon, Cash App bugs or system faults could result in unlawful transactions. These difficulties might be brought on by programming errors, server outages, or other technological issues that impair the app’s performance.

In such circumstances, Cash App could steal money without authorization as a result of a brief bug rather than with malicious intent. Reach out to Cash App help to notify them of the problem and request help if you believe a technical flaw or system malfunction is to blame for an illegal transaction.

If the issue is determined to be a technological error, they may reimburse any unlawful payments and assist in investigating and resolving the situation.

What to do if cash app taking money without your permission

Typically, Cash App transactions happen instantly. This makes recovering your money after being defrauded easier. However, the software provides strategies for contesting and recovering your lost money whenever feasible.

What to do if you transfer money to the incorrect person or business, detect money disappearing from your Cash App, or have other issues outside contesting a payment are listed below:

1. Refund Request

After stealing money, no con artist is prepared to give it back. But it can’t hurt to give it a shot. If you’re lucky, it could be a miscommunication. To request a refund:

- Open the Cash App and select the clock-icon-marked Activity tab above your balance.

- Select the transaction.

- Choose the top three dots by clicking them.

- Choose Request Refund from the list of available alternatives.

- Pick a justification for the return, such as “I did not authorize this payment,” for example.

- Press Next.

The receiver receives the refund request from Cash App. If they accept, you will get your lost money in 3 business days. After 30 days, Cash App payments might not appear on the Activity page.

2. Cancellation of Payment

It may take some time for the beneficiary of a Cash App transaction to get their money.If you’re lucky, you might be able to get your money back using the Cancel option by going through the steps:

- On the home screen, click the Activity tab.

- Choose Payment and tap the three dots.

- Choose Refund, and then select OK.

3. Stop automatic payments

Perhaps you aren’t the victim of a scam but are losing money to legitimate recurring bill payments. Check whether you have automatic bill payments set up and stop using unnecessary services.

You won’t be refunded for prior payments, but you may anticipate not having your account charged in the future.

4. File a theft report A Police Officer

The FBI and the police also have fraud sections that look into different types of fraud.

Informing the appropriate internet fraud agencies of your lost money can aid law enforcement in identifying the offenders and recovering your money.

Prevention Tips to Keep Your Cash App Account Safe

The following precautions will help protect your Cash App account and reduce the possibility of illegal transactions:

- Enable security features to safeguard your Cash App account like the Touch ID or Face ID password protection on the app.

- Check your history regularly, and report any suspicious behavior right away.

- Be careful while disclosing information about your Cash App, and avoid clicking on shady sites.

Conclusion

Cash App unauthorize transactions might be concerning, but you can better secure your account by knowing the potential causes and taking precautions.

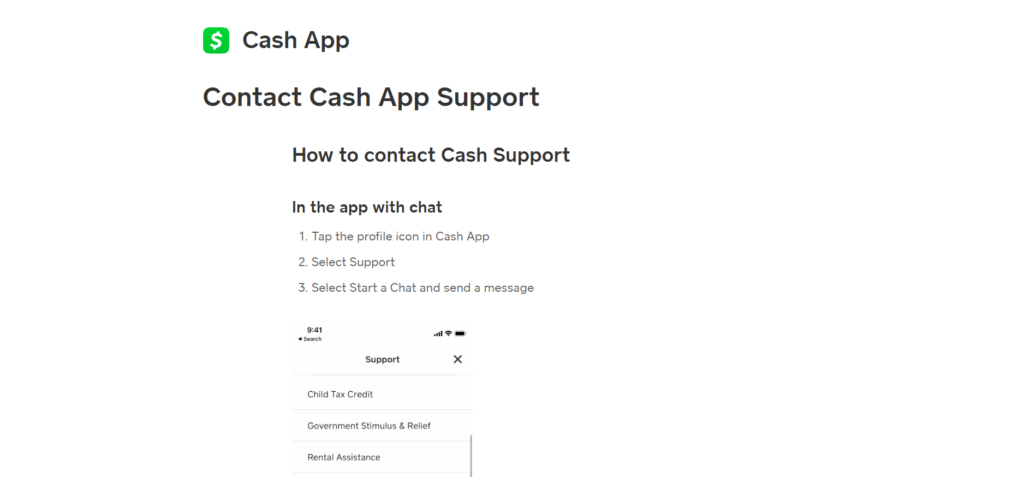

If you discover Cash App has stolen money without your consent, you should immediately contact Cash App help and your bank to discuss a solution. By being watchful and proactive, you may benefit from Cash App’s convenience while lowering the likelihood of fraudulent transactions.