Western Union is a popular financial service provider that offers money transfer services to people around the world.

It is a convenient way to send and receive money, especially for people who live in different countries.

However, there are limits to the amount of money that can be sent or received through Western Union.

If these limits are exceeded, the sender or receiver may encounter an error message that says the Western Union limit is exceeded.

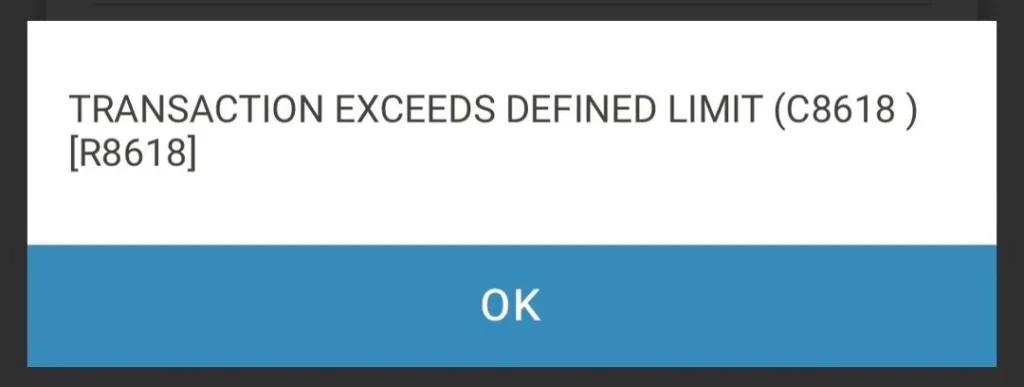

The full error message usually reads: “TRANSACTION EXCEEDS DEFINED LIMIT (C8618) [R8618]”

This can be frustrating and confusing, especially if you are not sure what it means or what to do next.

In this article, we will explore what Western Union Limit Exceeded means, why it happens, and what you can do to resolve the issue.

What Does “Western Union Limit Exceeded” Mean?

The message Limit Exceeds means that you have exceeded the amount of money that you can transfer from your account to another account. Western Union sets limits on the amount of money that can be sent or received through their service to prevent fraud and money laundering.

The limits vary depending on the country you are sending money from, the country you are sending money to, and the payment method you are using.

For example, in the United States, the maximum amount you can send per day is $5,000, while in India, the maximum amount you can send per transaction is INR 50,000.

If you reach the limit, you will receive a message about the limit being exceeded in Western Union.

What to do if the Western Union limit is exceeded?

If your Western Union limit is exceeded, then you should wait until the limit is reset, try splitting your transactions, and lastly, contact Western Union customer service.

If you have exceeded the Western Union limit, there are a few things you can do:

1. Wait until the limit is reset

Waiting until the limit is reset is one of the simplest solutions if you have exceeded the Western Union limit.

The limit is usually reset on a monthly basis, so you can wait until the next month to continue using the service.

This is a good option if you do not need to send or receive money urgently and can wait until the limit is reset.

However, it is important to note that the reset time may vary depending on the country and payment method you are using.

For example, some countries may have a daily limit that resets every 24 hours, while others may have a weekly or bi-weekly limit.

It is important to check the reset time for your specific country and payment method to avoid any delays or issues with your transactions.

Additionally, if you frequently reach the Western Union limit, it may be worth considering alternative money transfer services that have higher limits or no limits at all.

This can help you avoid any delays or issues with your transactions and provide you with more flexibility when sending or receiving money

2. Split your transactions

Splitting your transactions is another solution if you need to send or receive a large amount of money that exceeds the Western Union limit.

This involves dividing the total amount into smaller transactions that are within the limit. For example, if the limit is $2,500, you can split a $5,000 transaction into two $2,500 transactions.

To split your transactions, you can simply send or receive multiple transactions for smaller amounts until you reach the total amount you need to send or receive.

It is important to note that each transaction may be subject to fees, so it is important to factor in the fees when splitting your transactions.

Splitting your transactions can be a good option if you need to send or receive a large amount of money urgently and cannot wait until the limit is reset.

However, it may be more time-consuming and may result in higher fees compared to sending or receiving the total amount in a single transaction.

It is also important to note that splitting your transactions may trigger additional security measures from Western Union, especially if you frequently split your transactions or send or receive large amounts of money.

This may result in additional documentation or verification steps to ensure that your transactions are legitimate and not related to fraud or money laundering.

3. Contact Western Union customer service

If you need to send or receive money urgently and have exceeded the Western Union limit, contacting Western Union customer service is a good option.

They may be able to help you by increasing your limit or providing other solutions.

To contact Western Union customer service, you can visit their website and look for the contact information for your country.

This may include a phone number, email address, or chat support. You can also visit a Western Union agent location to speak with a representative in person.