CRA (Canada Revenue Agency) is the Canadian federal government service which oversees the collection of tax and governs law and policy related to tax.

It is also responsible for the registration of charities in Canada and for providing tax credits and benefits.

CRA is headquartered in Ottawa and is one of the largest organisations based on several employees. It also enforces the tax laws in the country.

Every year a business or individual is required to file for an income tax return which decides if they owe taxes and their amount or if they will get a refund.

This has been made easy by using the online CRA service where you need to create a CRA account.

You can get your notice of assessment easily from CRA after you file your Income Tax return using CRA services.

This article will discuss how to get your notice of assessment from CRA and what to do after you receive it.

What is CRA Notice Of Assessment?

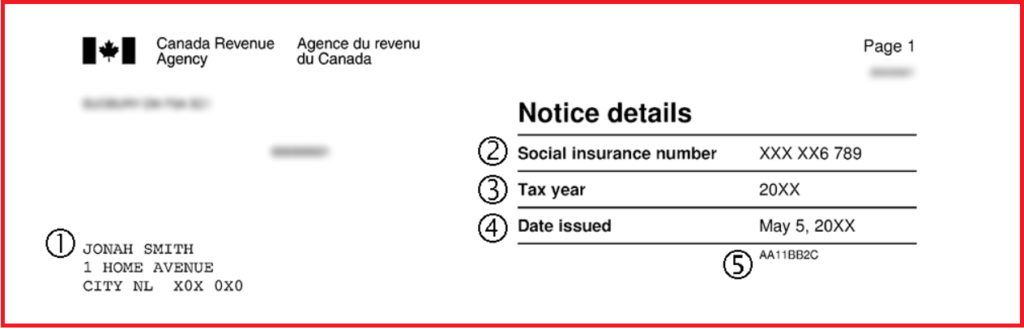

A notice of assessment is the receipt you receive from CRA after you file a tax return every year. It shows that the CRA has received and reviewed your tax return file.

Your notice of assessment will include the date of review of your tax return and how much you may owe, your credits or get in a refund.

It also contains your RRSP (Registered Retirement Savings Plan) deduction limit for that particular year.

How To Get Notice Of Assessment From CRA?

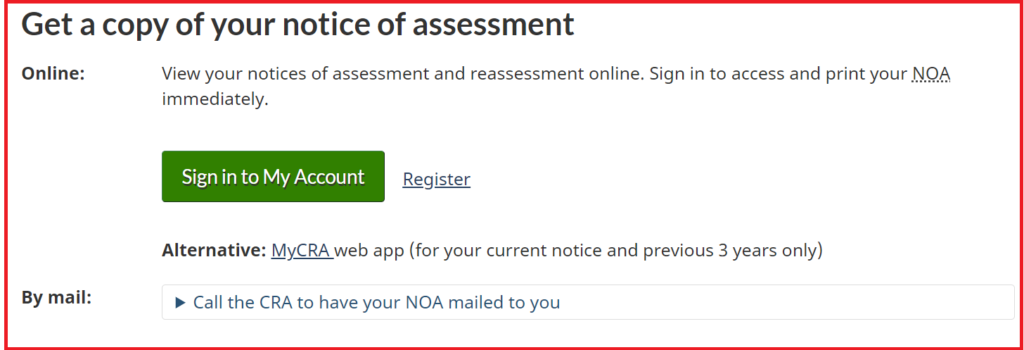

There are two ways to get your copy of the notice of assessment as per the CRA website.

You can get your notice of assessment online by signing in to your CRA account or registering for it if you don’t have an account. The other way is to get it by mail in paper form.

1. Receive Notice of Assessment Online

When you opt to receive notice of assessment online, ensure that your correspondence preferences are set to “Electronic mail”.

You will receive an email notification when the notice of assessment is sent to you by CRA via email and you should check in CRA My Account.

Also, remember that you will not receive any mail in the paper form. So if you want a paper copy of the notice of assessment then you can print it from email.

If you have not registered for email notifications then you can do it so that you are always aware of any new mail you receive from CRA.

To register for email notifications that you can receive from CRA, there are various ways which are mentioned below.

- Register for My Account where you will be asked to provide your email address.

- Sign in to your account through the CRA website. If you have not provided your email address then you will be prompted to enter it.

- Open the MyBenefits CRA web and there opt for “email address”.

- You can also provide your email when you file for a return with NETFILE software.

- When you send a paper tax return and benefit, there you can mention your email address.

- Mention your email address to your tax preparer who is filling out Form T183 or uses EFILE.

- You can contact Income Tax and Trust team by phone.

You can also read the Terms of Use for email notifications to understand the requirements and any changes in notification services.

After you register your email address, you will receive a confirmation email at the same address. You can also update your “notification preferences” by signing in to your CRA account.

2. Receive Notice Of Assessment By Mail

You can opt to receive a copy of your notice of assessment by mail in paper form and ensure that your correspondence preference does not have “Electronic mail” ticked.

You will be able to see the email in your CRA My Account but you will not receive any email notification.

To receive notice of assessment by mail you need to call the CRA and inform them to send it to you.

Before you make a call, you must keep the following things ready for identity verification:

- Social Insurance Number

- Full Name and Date of Birth

- Complete Address

- Notice of assessment or reassessment, other tax documents or keep your CRA account open by signing in.

You should be an authorized representative to call on behalf of someone else. The service remains closed on Sundays and any public holidays.

You can also get a proof of income statement instead which is a simpler tax assessment and contains the same information as the notice of assessment.

What To Do Next After You Receive Notice of Assessment?

When you get the notice of assessment, carefully review it for any errors and check if there are any changes made in the information that you provided to CRA.

You can go through the CRA Lessons to understand what is included in the notice of assessment.

Changes made by CRA can include your income or other sources of income that you may have missed, changes in deductions or credits that were claimed by you in your tax return.

If you think the changes made by CRA are incorrect or there are errors then you call CRA directly to resolve it.

But if you don’t agree with the changes and your issue is not resolved then you can file an official objection.

You will have one year after the filing deadline for the tax return or 90 days after the issue of notice of assessment whichever is later. You can also get a one-year extension in case you miss the deadline.

You should keep your notice of assessment safe in a file after you receive it. The CRA advises you to keep it with you for at least six years as they have up to six years to assess your tax return.

If you lose it then you can get it online by email which you can print again after signing in to your CRA account or call CRA to request a copy via mail.

You can reach out to the CRA Support team by calling on 1-855-330-3305 for individual-related issues.